SPK NETWORK WHITE PAPER

An incentivisation system for decentralised back-up storage on IPFS, file transfers, content delivery networks and encoding powered by Hive and Honeycomb .

| REV | DATE | ISSUE DESCRIPTION | BY |

| - | - | - | - |

| | | | |

| | | | |

| R2 | 27-SEPT-2024 | REVISED PER TESTNET LEARNINGS | SPK Proposal Team |

| R1 | 10-OCT-2023 | ISSUED FOR IMPLEMENTATION | The Hive Community |

| R0 | 01-MAY-2021 | ISSUED FOR FINANCING | The Hive Community |

# Contents

1. SUMMARY

1.1 SPK Network Diagram

2. SPK TOKENS

2.1 SPK Token Supply Expansion / Contraction

2.2 SPK Power

2.3 SPK Power for Governance Voting

2.4 SPK Power for Storage Capacity

3. LARYNX MINER TOKEN

3.1 How to Obtain LARYNX Miner Tokens

3.2 Mining Efficiency and Inflation

3.3 Delegation and Rewards

3.4 Reward Structure for Storage Providers

3.5 Delegation Strategy

4. BROCA GAS TOKEN

4.1 BROCA on Storage Contracts Determines SPK Token Distribution:

5. SIP (SERVICE INFRASTRUCTURE POOLS)

6. TOKEN USE CASE SUMMARY / TOKENOMICS

7. DECENTRALISED PROPOSAL FUND

8. WEB 3.0 CONTENT SITES & BREAKAWAY COMMUNITIES

9. IPFS STORAGE SYSTEM

10. PROOF OF ACCESS PERMA WEB

10.1 Proof of Access Diagram

11. SERVICE INFRASTRUCTURE NODES & MINING

11.1 Content Storage Nodes

11.2 Content Upload Nodes

11.3 Validator Nodes

11.4 Additional & Future Mining Types

12. OPEN SOURCE DESKTOP APP

13. UNDERLYING TECHNOLOGIES

13.1 Mining Mechanisms

13.2 Proof of Access System

13.3 NFTs

13.4 Service Infrastructure Pool (SIP)

13.5 SPK Network Proposal System (Phase II)

13.6 HIVE Blockchain

14. LIGHT ACCOUNT SYSTEM BLOCKCHAIN INTEROPERABILITY

15. COMMUNITY CONTENT REGULATION & DEMOCRATIC BLACKLISTING

15.1 Storage Miners and Content Validator Nodes Setting Content Policies

15.2 Custom Open Source Content Blocklists

16. LICENSING

17. CLAIM DROP

17.1 History

17.2 Unclaimed tokens:

18. PHASE II – FUTURE SCOPE

18.1 General

18.2 SIP (SERVICE INFRASTRUCTURE POOLS)

18.3. DECENTRALISED PROPOSAL FUND

18.4 Content Storage Nodes

18.5 Content Delivery Network Gateways

---

# 1. SUMMARY

The SPK Network is a decentralized Web 3.0 protocol that fairly and autonomously rewards value creators and infrastructure providers by distributing reward tokens. This ensures that every user, creator, and platform has the opportunity to earn rewards on a level playing field.

Over time, the SPK Network aims to offer decentralized storage, token creation, NFT creation, immutable breakaway communities, and direct digital ownership of creators' accounts and digital assets on a Web 3.0 DPoS protocol, where creators cannot be censored by centralized gatekeepers.

As the distributed successor to the legacy Web 2.0 big tech censors, the SPK Network will have no CEO and will be jointly owned by all participants who understand the importance of decentralization, freedom, and especially free speech.

When protocols replace CEOs and gatekeepers become communities, we can reclaim our natural right to free speech, a marketplace of ideas, and free, open debate.

- Website: [https://spk.Network](https://spk.network)

- Discord Chat SPK Network: https://discord.gg/RqhcNbqWJj

- SPK Network Telegram chat: [https://t.me/spkNetwork](https://t.me/spknetwork)

- 3Speak Desktop App platform: https://github.com/spknetwork/3Speak-app/releases/latest

- SPK Network Linktree: https://linktr.ee/spknetwork

- 3Speak Linktree: https://linktr.ee/3speak

- Proof of Access Linktree: https://linktr.ee/proofofaccess

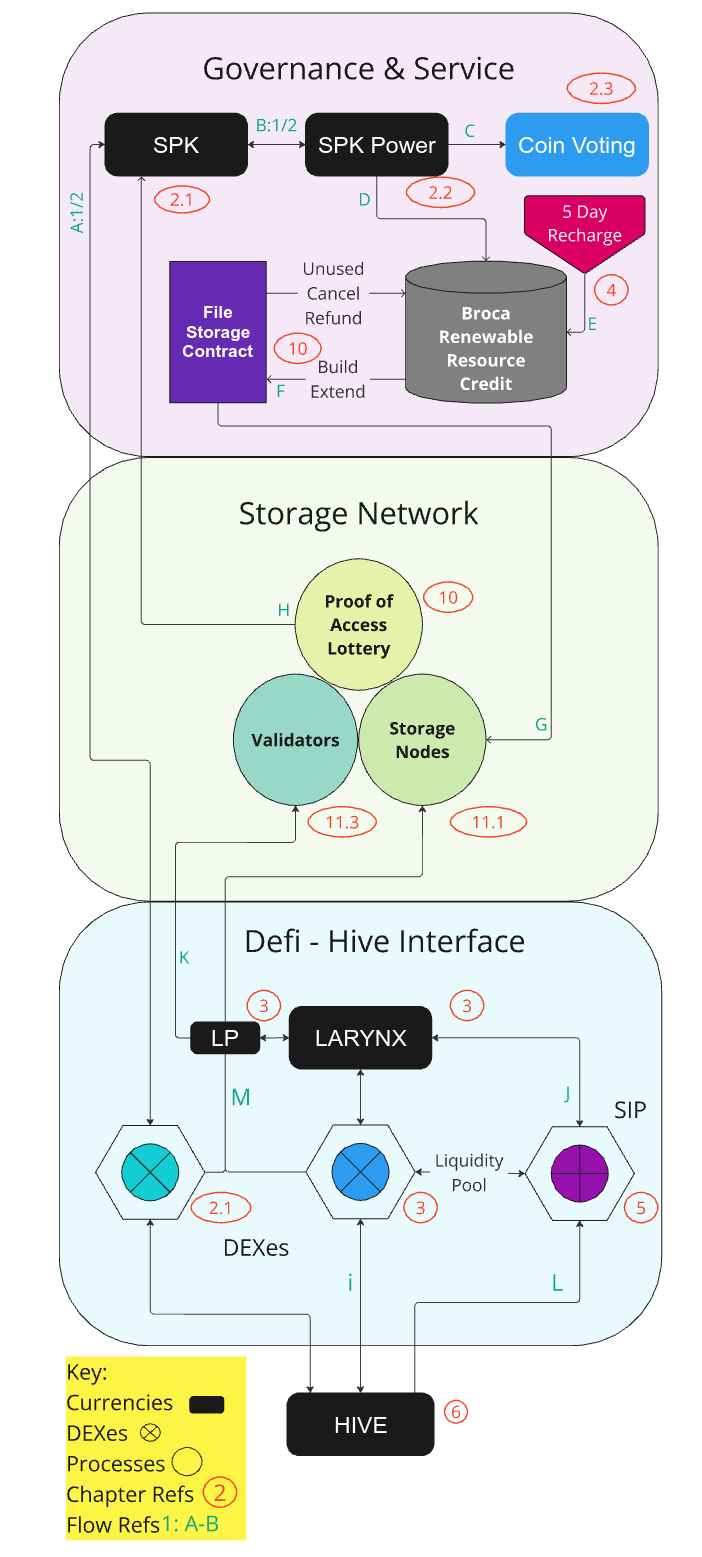

### 1.1 SPK Network Diagram

A1: Buy SPK Tokens from DEX's

A2: Sell SPK Tokens on DEX's

B1: Power up SPK Tokens to SPK Power

B2: Power down SPK Power to SPK Tokens

C: Use SPK Power to vote in SPK Network governance decisions

D: Obtain BROCA gas resources based on amount of SPK Power held

E: BROCA recharges over 5 days (20% per day)

F: Add BROCA resources to a contract - the more BROCA the longer the storage period and the more can be stored

G: Storage nodes can grab files from storage contracts and back them up - the more BROCA on a contract the bigger the rewards

H: Rewards paid out in SPK based on amount of BROCA on storage contracts

i: Mine more efficiently by obtaining LARYNX Miner tokens from the SIP by paying in Hive and competing in the daily reverse auction

J/L: Mine more efficiently by obtaining LARYNX Miner tokens from the SPK DEX

K/M: Validator and storage nodes must power up their LARYNX Miner tokens in order to mine in the network. The more LARYNX powered up, the more efficently the node mines SPK Tokens

---

# 2. SPK TOKENS

The SPK token serves as the governance token of the network. SPK token holders can influence the governance of the network through their voting power, which is determined by the amount of SPK they have powered up. To vote, users must power up their SPK, with full voting power becoming available after 30 days. This delay helps the network protect itself from potential Sybil attacks.

The SPK token also represents the provable storage capacity of the SPK Network. Proof of Access (as outlined in Section 10) drives SPK inflation, distributing rewards to service providers and those who delegate their LARYNX Miner Tokens (Section 3).

Additionally, users can stake their SPK tokens to access BROCA, the network's gas or resource credit token. This means that the network's provable storage capacity is distributed among SPK token holders.

### 2.1 SPK Token Supply Expansion / Contraction

Under normal operation, the network’s storage capacity is assumed to gradually expand, and the SPK token issuance adjusts its inflation rate accordingly to match the utilization of available storage within the network.

In times of extreme network growth, the SPK token supply can rapidly expand to meet new demand. This occurs when storage utilization exceeds 60% of the network's capacity for a 24-hour period. During such periods, the SPK supply increases to ensure there is enough BROCA (the network's resource credit or gas token) available in users' accounts to support new storage contracts. Newly issued SPK tokens are distributed to users running nodes with proven storage capacity, with the expectation that they will stake these tokens, thus recharging their BROCA tokens. This helps incentivize new storage contracts and meet the surge in storage demand. Delegators of LARYNX miner tokens to these storage operators also receive a portion of the newly issued SPK tokens. Additionally, users operating storage validator nodes are awarded a share of the new SPK tokens under these expansionary conditions.

In contrast, when the available storage is shrinking, the SPK token employs Deflationary Frictionless Staking (DFS). This system penalizes "weak hands" (those who sell or unstake) and rewards "strong hands" (those who hold and stake). To implement DFS, during periods of shrinking storage capacity, a nominal fee, called the "Transaction Tax," is applied to every transaction or DEX trade. This fee is proportional to the rate of storage deflation and is burned, reducing the SPK token supply. This mechanism increases the relative value of remaining tokens and aligns the provable storage capacity with the token supply.

It is important to note that during normal storage growth or extreme network expansion, as outlined above, the DFS fee is not applied.

### 2.2 SPK Power

SPK exists in three possible forms: liquid (simply called SPK), staked for liquidity provision, or powered up (known as SPK Power). SPK is one of the liquid currencies of the network and can be traded, staked, powered up, bought, or sold.

SPK Power (SP), the staked version of SPK, is created through a process called "powering up." Once powered up, SPK Power can be fully or partially un-staked at any time, through a process known as "powering down." During power down, SPK Power converts back into its liquid form (SPK) over a four-week period, with a portion released every 7 days.

### 2.3 SPK Power for Governance Voting

Holding SPK Power grants users governance rights within the network. The more SPK Power a user has, the more influence their vote holds. SPK Power also determines a user's ability to influence network variables directly. If a user doesn't vote on network variables, their vote is automatically proxied to the elected content validators, ensuring no vote is wasted or inactive.

### 2.4 SPK Power for Storage Capacity

SPK Power is tied to the resource credit BROCA, with 1 SPK Power generating up to 1,000,000 BROCA, which replenishes over a five-day period. This amount of BROCA can purchase 1,000,000 Kb of network storage for 30 days. Under normal conditions, the network targets a capacity of up to 6,000,000 Kb (~6GB) of continuously renewing storage contracts per SPK Power in a user’s account (6 x 5-day periods in 30 days).

SPK staking is a proposed feature for the SIP in Phase II (see Section 18).

---

# 3. LARYNX MINER TOKEN

LARYNX exists in four possible forms:

1. **Liquid form (simply called LARYNX)**: LARYNX in its most flexible state, which can be traded, bought, or sold.

2. **Locked for Mining via service registration**: This form requires LARYNX to be locked alongside running infrastructure in the network, allowing storage node operators to mine SPK tokens. Once locked for mining, LARYNX cannot be unstaked.

3. **Powered up for delegation to storage node operators**: Users who are not running infrastructure can delegate their powered-up LARYNX to storage node operators, allowing them to earn SPK tokens.

4. **Staked for DEX collateral provision**: Users can stake LARYNX as collateral for decentralized exchange (DEX) purposes. This can be unstaked and enables users to mine SPK tokens. The more LARYNX staked for DEX collateral, the more efficient and profitable SPK mining becomes.

### 3.1 How to Obtain LARYNX Miner Tokens:

- **Sending HIVE to the SIP**: Initially, the HIVE is distributed to Proof of Access infrastructure providers. In the future, community consensus updates may direct a portion of this HIVE to stay within the SIP as permanent liquidity that grows over time.

- **Buying LARYNX Miner Tokens on the open market**.

LARYNX Miner Token inflation is auctioned daily through purchases made from the SIP. Users who send the most HIVE to the SIP on a given day will receive the largest proportion of that day's LARYNX Miner Token supply.

### 3.2 Mining Efficiency and Inflation:

Locking LARYNX for mining increases mining efficiency. However, due to inflation, the effectiveness of LARYNX in mining will decrease by half over every two-year period (100% inflation over 24 months).

### 3.3 Delegation and Rewards

Any network user can delegate their locked LARYNX to infrastructure providers, allowing them to earn a fixed percentage of the provider's SPK rewards. This delegation system allows users who are unable to operate infrastructure to still support the network while receiving rewards in return. Infrastructure providers benefit from LARYNX delegations, as they can allocate their capital to expanding their infrastructure.

### 3.4 Reward Structure for Storage Providers:

A storage provider’s rewards are based on the total amount of LARYNX they have staked and delegated, relative to the total staked and delegated network-wide:

- **Lowest 15th percentile**: 1 part rewards.

- **16th to 85th percentile**: 2 parts rewards.

- **86th to 100th percentile**: 3 parts rewards.

Storage node operators receive SPK inflation rewards based on the proven storage capacity they provide. This creates a LARYNX miner token delegation market with rewards driven by market dynamics. It also incentivizes users who don’t run infrastructure to delegate their LARYNX Miner Tokens to storage operators, sharing in the operators’ rewards.

### 3.5 Delegation Strategy:

LARYNX Miner Token delegators can optimize their rewards by delegating to lower-ranked but reliable storage operators. These operators may have fewer delegations, meaning the delegators don’t need to share the rewards with as many others. This creates an arbitrage opportunity, as delegators who choose reliable, lower-ranked operators can potentially earn more rewards compared to those delegating to higher-ranked operators, where the rewards are divided among more participants.

---

# 4. BROCA GAS TOKEN

BROCA is the network's gas token, consumed when users upload content and automatically regenerating as long as the user holds SPK Power. Similar to how Ethereum users pay gas fees to process transactions, content uploaders and platforms on the network provide BROCA tokens as an incentive to infrastructure providers, such as storage node operators.

Though not liquid, BROCA can be bundled into third-party storage contracts, allowing platforms to offer a free experience to first-time users by providing them with pre-loaded storage contracts. This enables users to store content without needing to buy BROCA initially.

Each BROCA token allows for 1KB of backup storage across three separate storage nodes for a period of 30 days. Storage contracts can be extended proportionally by sending more BROCA, which adjusts the contract's duration. If additional backup storage is required, users can pay extra, for example, adding 1/3 more BROCA to incentivize a fourth storage node to store their contract.

Contracts must begin with a minimum of 100 BROCA to deter spam. Any unused BROCA is refunded to the contract funder. This allows platforms to create storage contracts that facilitate file uploads for their users based on the BROCA/KB amount, with refunds for any unused portions.

As the network’s Proven Storage Capacity grows, SPK is minted and staked, leading to a proven storage-backed expansion in the BROCA supply. This ensures that BROCA can always be used to purchase additional storage capacity on the network, maintaining liquidity based on Proven Network Storage supply.

### 4.1 BROCA on Storage Contracts Determines SPK Token Distribution:

BROCA on contracts drives the distribution of SPK paid to storage nodes. Storage nodes receive SPK Tokens for providing successful storage proofs based on the amount of BROCA attached to the contracts they are storing.

---

# 5. SIP (SERVICE INFRASTRUCTURE POOLS)

Service Infrastructure Pools (SIPs) are DeFi pools that autonomously sell digital products to a community in exchange for payments into the pool. These payments are used to create a liquidity pool with no owners or initial stakers. If the product remains in continuous demand, its sale generates growing capital for liquidity provision. The fees from this liquidity pool are returned to subsidize the network's key infrastructure providers. This structure allows SIP operators and major network infrastructure operators to earn fees instead of centralized exchange operators.

SIPs executed on Delegated Proof of Stake (DPoS) chains enable the network to perform fee-less, nearly instant DeFi transactions, making them highly competitive compared to traditional DeFi systems.

In the SPK Network, the SIP sells LARYNX Miner tokens, which are inflationary and have continuous demand from miners and storage operators who need to lock LARYNX Miner Tokens to enhance mining efficiency. The SPK Network SIP also provides liquidity to the DEX and conducts LARYNX Miner Token auctions.

LARYNX Miner Tokens can either be powered up and delegated or staked as collateral for securing the DEX and LARYNX auctions. While SPK is directly tied to network storage resources, LARYNX’s value is proven through daily auctions and its role in the DEX.

SIP Node Operators (DEX operators) stake LARYNX as collateral, providing liquidity to the SIP, which is also the SIP liquidity pool. These operators receive LARYNX at a rate aligned with its inflation, removing the inflationary penalty for holding LARYNX as collateral. The inflation and DEX fees are distributed to SIP/DEX infrastructure operators, ensuring that, despite high inflation, LARYNX remains a stable collateral compared to SPK, which represents network utility.

For certain applications like liquidity provision and collateralization on the DEX/SIP, the network uses unparametered coin voting (Proof of Stake) with staked LARYNX Miner tokens as the governance model. The primary factor in securing multisignature liquidity is the amount of collateral staked by operators. The more collateral staked, the more they stand to lose in case of collusion but also the more rewards and governance influence they gain, including factors such as fees and collateral requirements.

In contrast, governance of the SPK Network for content storage and regulation is more socially driven and uses parametered coin voting (DPoS) weighted by SPK Power stake. The community elects the most influential infrastructure operators, allowing even users with small stakes to influence the network by electing representatives to set key governance variables.

DEX/SIP operators can also run SPK Network storage nodes and be elected into the top 20 SPK Network Content Validator positions by the community. SPK Power holders vote on DEX fees, and if DEX/SIP operators are elected as content validators, they gain an additional income stream from validator rewards, potentially allowing them to run the DEX with lower exchange fees.

By contrasting DPoS (SPK) for SPK Network and storage governance with PoS (LARYNX) for DEX/SIP governance, the network ensures optimal functionality for both areas while keeping exchange fees low. The incentives for both governance systems are related but non-competing.

In **Phase II**, the SIP model will be further developed (see Section 18). The vision includes extending the SIP model to various digital services on DPoS chains, not limited to infrastructure providers for content but adaptable to other types of infrastructure.

**Important Note on Current SIP Configuration:**

At present, SIP/DEX node operators earn from DEX fees, while storage providers earn both BROCA and SPK rewards through the Proof of Access algorithm. Additionally, they earn all HIVE paid into the SIP for LARYNX Miner Tokens. In the future (Phase II - see section 18), HIVE paid into the SIP will remain as permanent liquidity, and a portion of DEX/SIP exchange fees will be paid to DEX node operators and storage infrastructure providers.

---

# 6. TOKEN USE CASE SUMMARY / TOKENOMICS

| Token | Uses | Transaction Fee | Obtain by | Inflation Model |

|---|---|---|---|---|

| LARYNX | - Improve mining efficiency - Delegate to storage providers to earn SPK - Provide DEX Collateral - Register Network Services |

Feeless | Purchase from SIP DeFi Pool | 100% in 2 Years |

| BROCA | - Pay for Storage - Network gas token / resource credits |

Feeless | Powering up SPK | 1 SPK Power allows up to 1,000,000 BROCA, replenishing over 5 days |

| SPK | - Power Up for Governance - SP Stake Weighted Governance - Powering up replenishes BROCA balance |

Transaction fee if Network storage is contracting | Store content Delegate to storage providers to earn SPK |

- Inflates with proven network storage - Deflates with decreasing network storage |

| HIVE | - Daily auction of LARYNX Miner Tokens | Feeless | Storing Content | Inflationary |

LARYNX Miner Tokens are locked for mining alongside Network infrastructure provision by the Miner. The min