With Rebellion and Land here, my plan to rent gold foil cards "against the grain" has been working well.

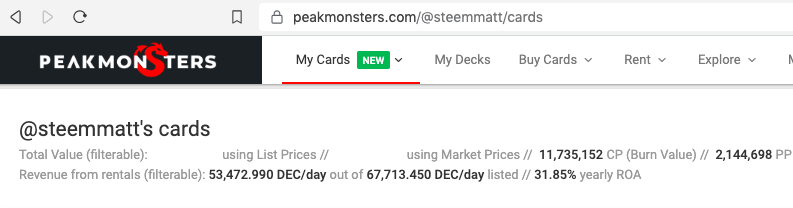

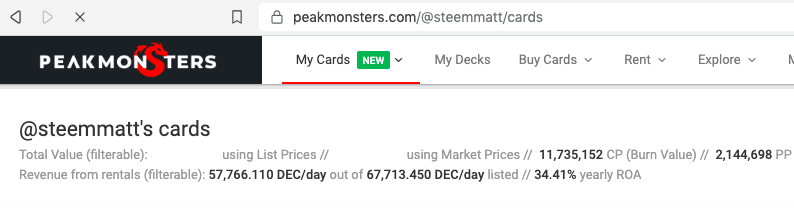

Here's a snapshot of my first weekend day where I had most of my gold deck available for rent. Note that there are still 4 hours left to run on this tournament day, so this could rise a bit.

That's 79% DEC fulfillment. Not too shabby, and a good indicator that I'm on the right path relative to my goals. If you rent from me, thank you for your business.

UPDATE: 85% DEC fulfillment within a few hours!

While many rentals are currently for more than the minimum of 2 days, this will be a solid weekend of earnings. The proceeds will be rolled over into more Untamed and Chaos Legion golds. I will gradually ease into Rebellion once my checklist of other cards is complete, or I may sit it out for longer to let the supply build. If I'm not going to play much for a while, Rebellion assets aren't vital right now.

As planned for and expected, rental markets for many rarer max cards seem paper thin. Demand has also remained on track during weekend tournament/end of season, perhaps getting even strong as SPS starts to recover. Normal weekday returns have also been solid in the 16K-20K DEC range so far. This may improve as I manually tune prices and monitor the landscape. Where others rely on automated rental services for a fee, I love managing the rentals manually.

Assuming 100K per weekend and 90K per over 5 weekdays, that computes to 190K per week, and 760K DEC per month. Add or subtract 15% and I'm still in good shape, especially if DEC stays near peg.

It takes extra patience to sit on sidelines while Rebellion cards are available on the market, mainly since I want to learn how they perform, but I don't feel the pull. As with my UT and CL card acquisition strategy -- packs aren't for me, so I'll scoop up the deals with the rental DEC and SPS from my Liquidity Pool as they become available. Now's not the time though.

The key for me is making moves when excitement has subsided, when there's more supply, and more people turn from buyers into sellers. I think I'm done spending off-chain assets, so I want to maximize my purchasing power. I spent enough and need to replenish those funds.

On the land side, I do have a few plots with the building in a box on standby. Given the info above, the concept of staking high PP cards + DEC for SPS, grain, or research doesn't appeal right now. If I didn't have a strong DEC factory, it'd be a different story. I understand that research can't be bought, but I'm confident that rental income will help me catch up on what I missed. I'll also have many more rare gold cards for the long haul before eventually switching to a land focus. It's not always about the card price for the rarer ones, but a matter of enough supply to max them out. A deeper arsenal will also allow me to spare more high PP copies without worrying about too much lost rental income.

For example, it doesn't make sense to lock up 50K DEC and 100K of PP on a plot just to make a few bucks in a month, when I can make a few bucks in a day with the same units. Perhaps I'm shortsighted to some for passing on land, but I paid the price to buy plenty of cards with external assets when others were dumping over a full year to get to this position. Coupled with plenty of impermanent loss from this and the liquidity pool I've been churning away in, that's plenty of long term vision in crypto land in my view.

Obviously, renting everything is at the great sacrifice of game play, tournaments, and rewards chests, but I don't mind. I didn't have too much luck with chest rewards I earned across Diamond and Champion, so not much to miss there. I also played more games (manually) than almost anyone else every season, and it was exhausting. With the alternative to passively earn DEC, and the passion to manually adjust prices as needed, it's a no-brainer. It also keeps me flexible, liquid, and constantly involved in a fun part of the economy. I can buy the rewards cards later when they're no longer soulbound.

Also, long term, as SPS rises, rental costs should rise... In turn the DEC returns should grow substantially if rental markets remain as thin as they are for the upper tier of UT/CL gold cards. Long-term planning lined up for a probable bull run and thousands of new players who will want and need access to the cards I've accumulated. Supply and demand crunch ahead!!

That's it for now. Thanks for reading.

@steemmatt