Warren Buffett’s Berkshire Hathaway just announced its latest financial results — and brace yourself… it has accumulated $382 BILLION in cash! And why does that matter? Because that money is not sitting there by accident. When the most legendary investor of all time hoards this much liquidity, he’s preparing for something. Not for tomorrow. Not for next year. But for the right moment. And what moment is that? Nobody knows — except Buffett himself.

BERKSHIRE’S RESULTS

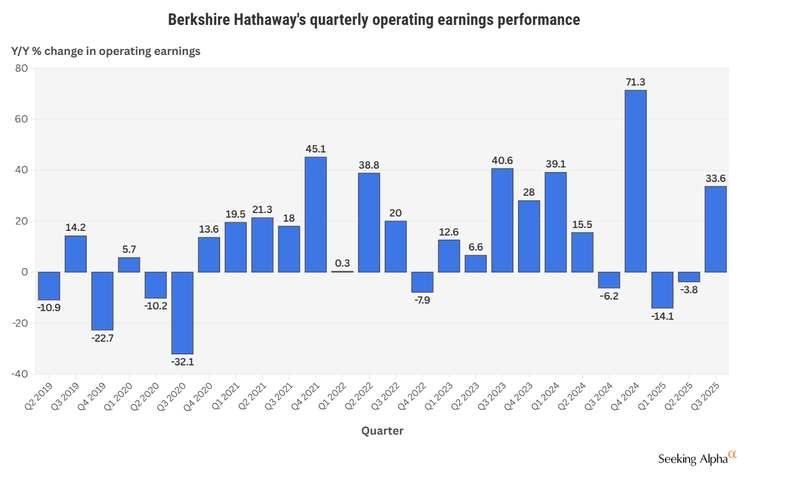

Berkshire Hathaway reported a 34% increase in operating profits for Q3 2025, reaching $13.5 billion.

The company’s insurance division performed exceptionally well, with underwriting profits exceeding $2.3 billion — almost triple last year’s.

At the same time, total net income rose to $30.8 billion, a 17% increase compared to the same period last year.

And while the numbers are soaring, what is Berkshire doing? It’s not buying, not taking risks, not investing aggressively. No major repurchases, no bold acquisitions. Instead, it’s piling up cash — from $344 billion in the summer to $382 billion by September — a new all-time record. Never before in history has so much money been held on a single corporate balance sheet.

REACTIONS AND RUMORS

And here come the questions: Why isn’t he investing it? Why no share buybacks? Why not take advantage of the market pullbacks? What’s the purpose of all this waiting?

Many investors are frustrated. They see Berkshire sitting on mountains of cash while the stock underperforms the S&P 500.

They claim the famous “Buffett premium” has disappeared — the extra valuation investors used to pay simply because they trusted Buffett’s judgment. And they’re not entirely wrong. Buffett hasn’t done any buybacks in the first nine months of 2025, even though the stock had corrected significantly.

What’s truly impressive is that Berkshire’s $382 billion cash pile is larger than the market capitalization of giants like Procter & Gamble, Morgan Stanley, and McDonald’s — and many others. We’re talking about an amount that exceeds the GDP of small nations. It’s the financial power of a country, held in the hands of a single man.

THE JUICY PART

Now come the juicier theories.

Some say Berkshire is building its cash reserves because it’s getting ready for something big — waiting for a market crash to swoop in and buy everything cheap. Others believe Buffett sees weakness in the system that the rest of us can’t yet detect. And a few bold voices even suggest he might be preparing to acquire Coca-Cola ($KO)! Yes, Coca-Cola — one of Buffett’s most iconic and emotionally significant investments for decades. Such a move would be historic — legendary, even.

Whatever the truth may be, one thing’s certain: When Buffett starts hoarding cash, the world takes notice. And when that pile grows larger than the value of dozens of corporate titans combined, you simply can’t ignore the signal.

Whatever he’s planning — it’s going to be big.

Posted Using INLEO