What is happening in the U.S. labor market, and how does this affect the Central Bank’s decisions? The U.S. remains the strongest economy in the world, and developments there influence our own returns as well. From interest rate decisions to market movements, everything starts with fundamental economic data—such as employment.

THE NEW LABOR MARKET DATA

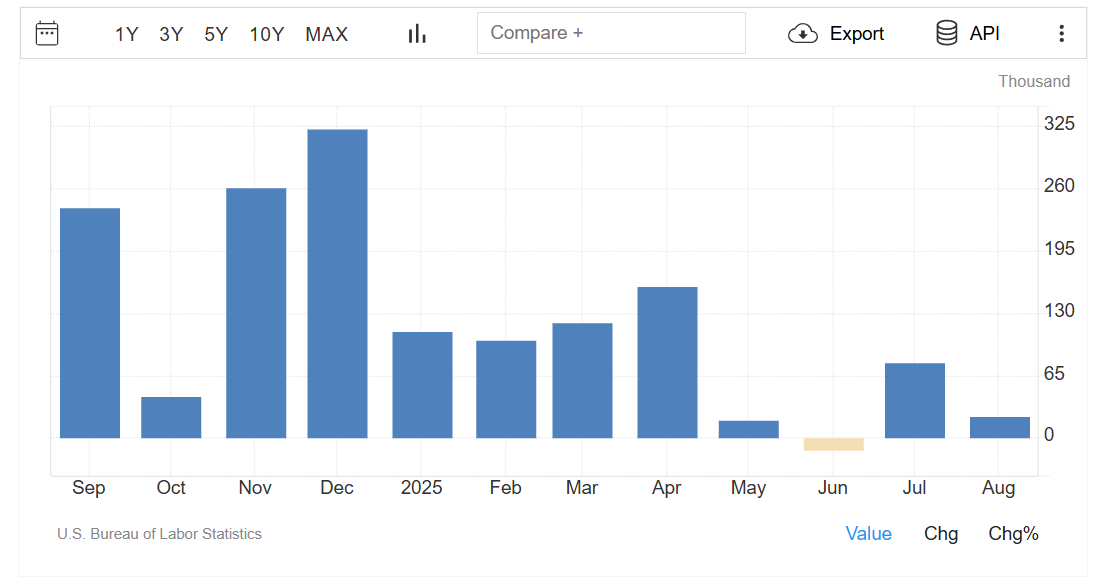

According to the latest figures from the Bureau of Labor Statistics, only 22,000 new jobs were created in August, while analysts had expected 75,000. The gap is huge and shows that the labor market has started to lose momentum.

July was revised slightly upward, from 73,000 to 79,000, a small positive surprise. But June… was completely overturned. From an initial 14,000 jobs gained, the final estimate dropped to -13,000. In other words, jobs were lost instead of created.

Overall, revisions to the previous two months show 21,000 fewer jobs than we previously thought. And this is important because it changes the interpretation of the broader trend in employment. We are no longer talking about stability, but rather about a slow, gradual erosion.

UNEMPLOYMENT RATE & WAGES

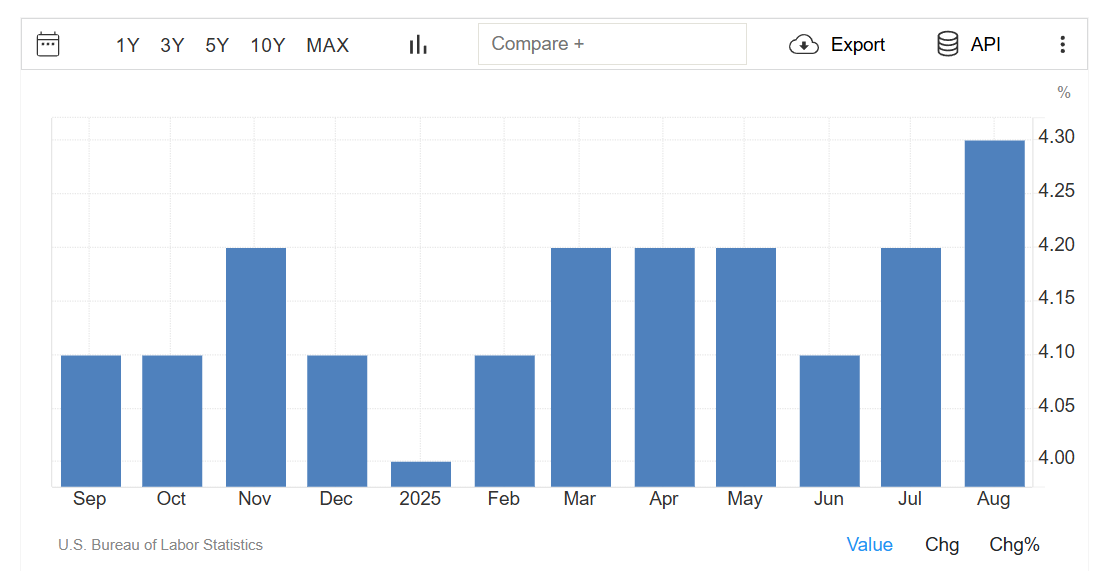

Unemployment rose to 4.3% in August, up from 4.2% in July—the highest level in recent months.

Meanwhile, average hourly earnings increased by just 0.3% month-on-month, and slowed to 3.7% year-on-year (from 3.9% in July). In other words, we are seeing signs of fatigue in wage growth as well.

Average weekly hours remained at 34.2, slightly below expectations, and unchanged for the third straight month.

An interesting detail: labor force participation rose by 436,000 people, which prevented the unemployment rate from climbing even higher. This is surprising, especially considering that immigration has been significantly restricted in recent months due to policy decisions.

WHAT DOES ALL THIS SHOW?

The labor market is slowing down, but it is not collapsing. We are not seeing mass layoffs or a sharp spike in unemployment. But we are seeing continuous weakening across many sectors—especially in cyclical industries like manufacturing and business services.

By contrast, healthcare continues to add new jobs, showing a shift toward more “defensive” hiring—sectors with steady demand, like healthcare and social services.

In short, this is a smooth, controlled weakening of the labor market, which clearly paves the way for interest rate cuts. The Fed wanted to see the labor market “cool,” and that seems to be exactly what is happening.

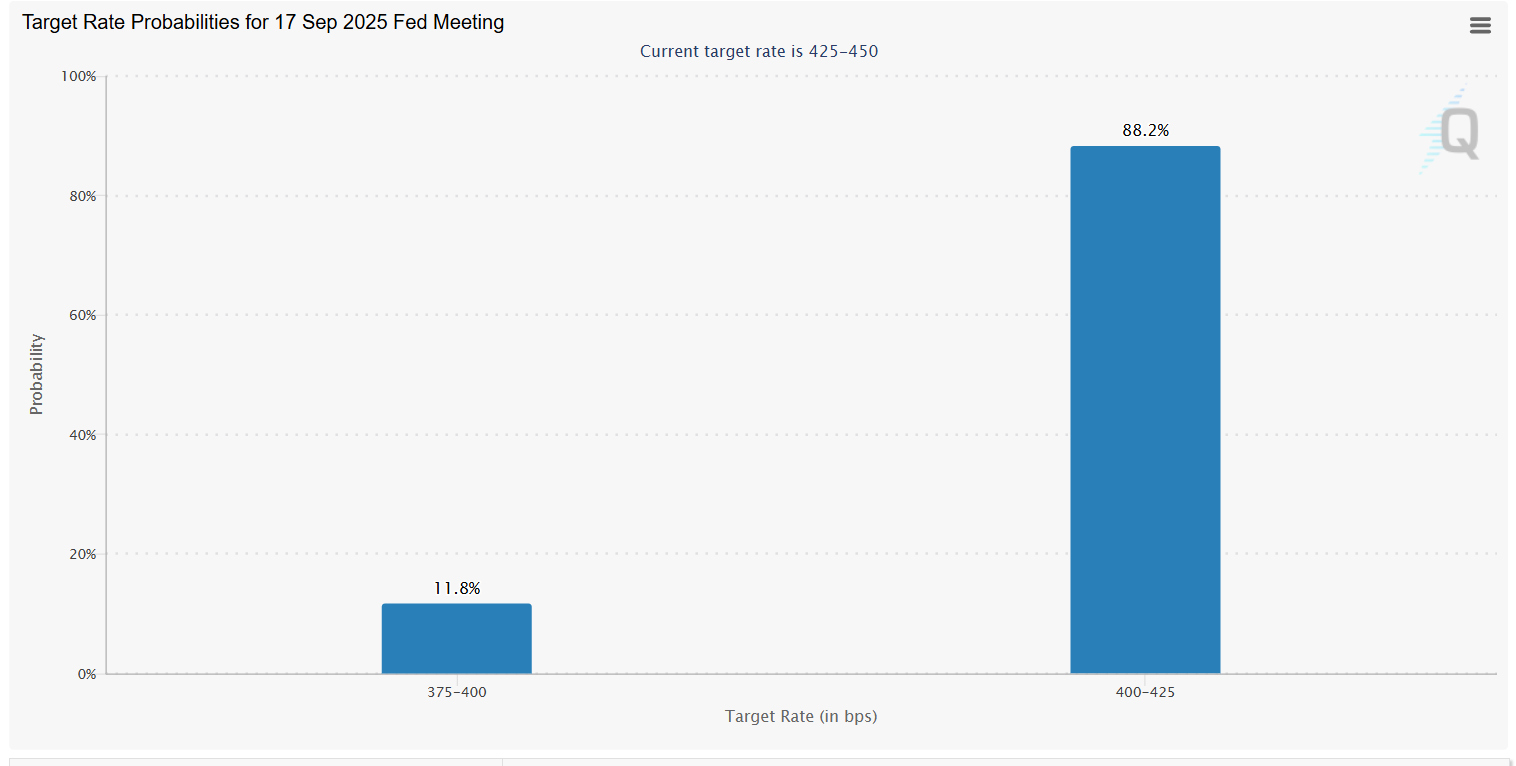

According to the most recent data from the FedWatch Tool, the probability that the Fed will cut rates at its September 17 meeting is now 88.2%. Yes, you read that right—one hundred percent.

Everything points to a 0.25% cut, from 4.25% to 4.00%. This will be the first rate cut since December.

And that is very good news for the markets. Lower rates mean cheaper money, more growth, and naturally, higher equity valuations. It may also mean more attractive loans, more active entrepreneurship, and fresh momentum in consumer spending.

Posted Using INLEO