How to survive… THE COMING CRASH!

DOOMSDAY TALK

Let’s start with the two heavyweights of Wall Street: Goldman Sachs and Morgan Stanley.

According to David Solomon, CEO of Goldman, in the next 12–24 months we could see a 10–20% drop in the markets. He said it during a conference in Hong Kong, and the headlines screamed: “THE CRASH IS COMING!”

But he added something very important:

“This is absolutely normal.” It’s part of a healthy cycle. And most importantly, it doesn’t change anything in the company’s core capital allocation strategy.

Similarly, Ted Pick of Morgan Stanley stated that such corrections are not only expected but welcome! Why? Because they flush out excessive optimism, release market pressure, and lay the foundation for the next leg up.

On the other hand, Josh Brown, CEO of Ritholtz Wealth Management, has a different take. He argues the correction isn’t coming — it’s already here.

30% of S&P 500 stocks are already down more than 20% from their highs — technically in bear market territory. And about 6.5% are at 52-week lows.

The only thing keeping the broader indices afloat are the so-called “Magnificent Seven” — the mega-tech stocks dragging the averages upward.

So what do we really have? A market that looks healthy on the surface but has already undergone an internal correction beneath the hood.

Bull markets need to breathe. This is the best setup for a strong year-end rally.

If that still sounds too mild, then brace yourself for the “doom scenarios” painted by analysts like Nicholas Brooks, Charles-Henry Monchau, and Lee Robinson:

- U.S. consumers are under pressure — layoffs, rising credit-card delinquencies, and weaker spending.

- The AI investment mania might not live up to the hype.

- Inflation could come back if consumption rises and spending surges again.

- Central banks might delay rate cuts, especially if inflationary pressures return.

- The bond market could revolt — a “bond revolt” — sending yields soaring and squeezing equities.

- And of course, there’s always the risk of trade wars, especially with Trump’s rhetoric heating up.

INVESTMENT TAKEAWAYS

Let’s get serious for a moment.

These kinds of warnings are nothing new. Every time the market corrects — or even rises too fast — voices appear predicting “the crash.”

Some call it a bubble. Others a looming crisis. And in the end? Most of the time, nothing truly catastrophic happens. And even when it does, it’s rarely as devastating as predicted.

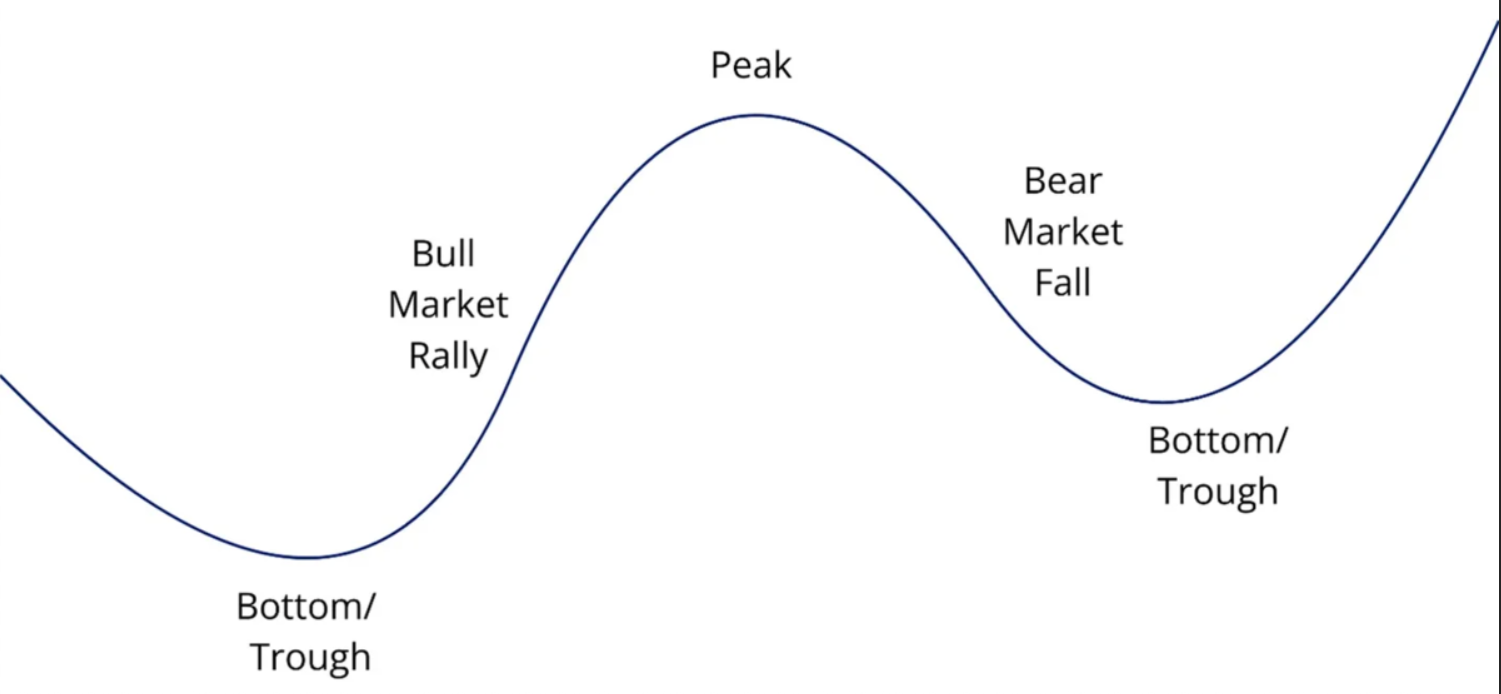

The market moves in cycles — up and down. It’s not a straight line. Drops, pullbacks, volatility — they’re all natural.

So what should we do? DON’T try to predict when the market will fall or rise.

Because we know one thing for sure: No one — not Goldman, not Morgan Stanley, not me, not anyone — can do that with accuracy.

The answer is: have a strategy, follow it, and take profits from time to time.

Posted Using INLEO