Two critical economic updates have just been released: the new reading for Core PCE, the Fed’s favorite inflation gauge, and the revised U.S. GDP for Q2 2025.

CORE PCE

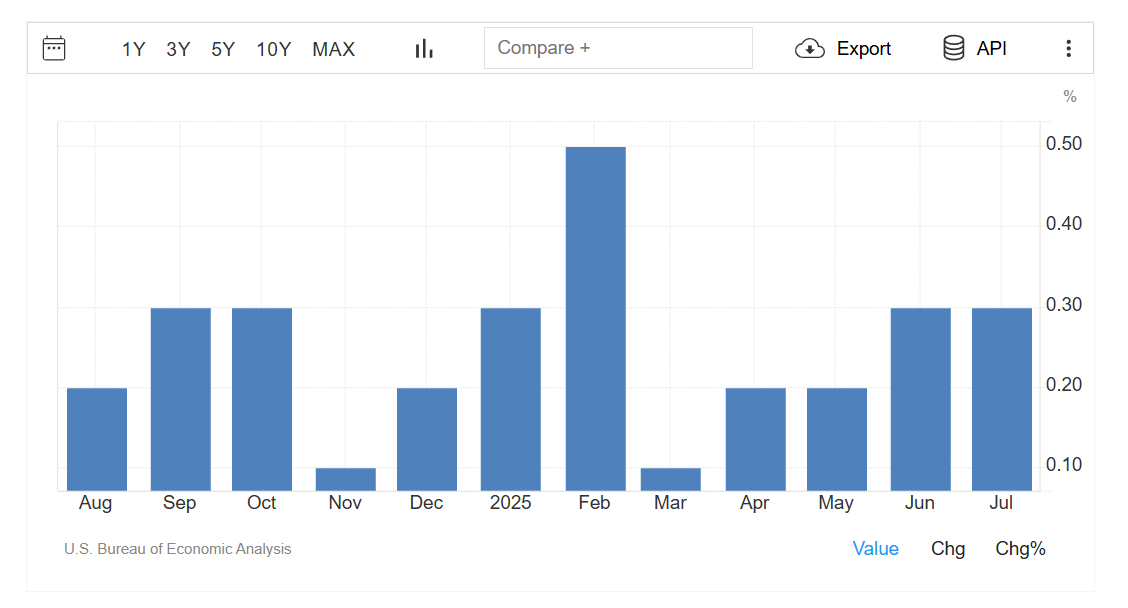

Let’s start with Core PCE, considered the most reliable inflation indicator by the Fed.

The July reading came in exactly as analysts expected: +0.3% month-over-month

and +2.9% year-over-year. The same rate as the previous month, showing a stability that the central bank has been eager to see.

What does this mean? That there were no unpleasant surprises. No sudden spike to scare the markets or the Fed. The situation remains under control, giving relief both to investors and consumers. Essentially, we are in a stabilization phase: inflation is still above target, but it’s not intensifying. And that is hugely important—because after the shocks of the last two years, seeing “calmer waters” is progress in itself.

And why does this matter so much? Because, according to market analysts, this figure opens the door for a rate cut at the Fed’s next meeting. That would mean cheaper money for businesses and households. Which means more liquidity in the markets. And ultimately, a supportive environment for stocks.

Caution though—this doesn’t mean the inflation fight is over. It’s simply a step toward normalcy.

GDP

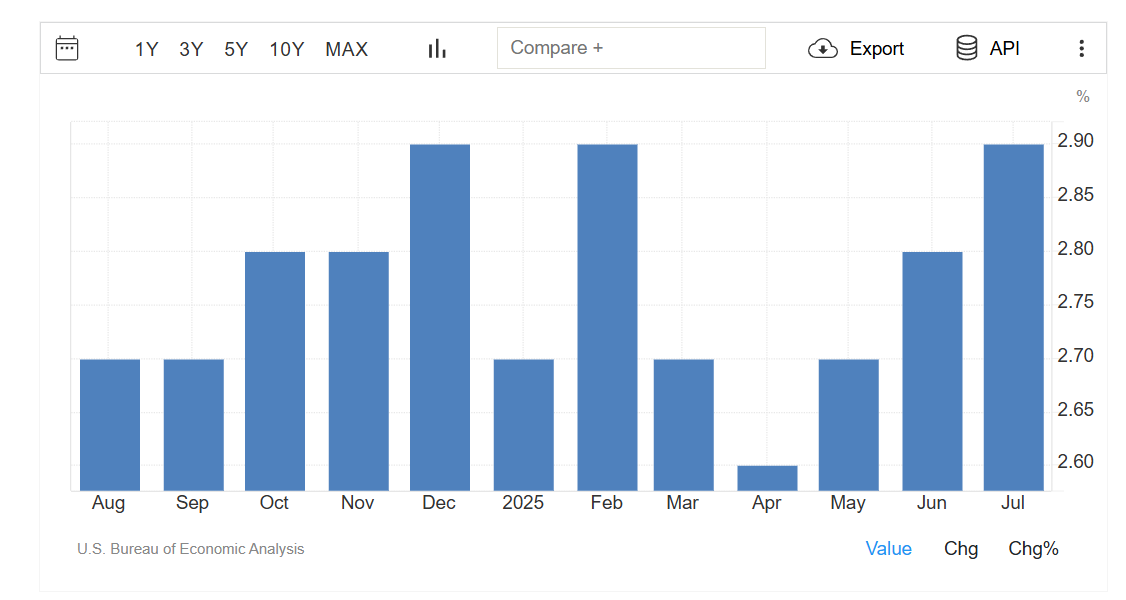

Now to GDP. The U.S. Department of Commerce revised Q2 growth upward to +3.3%, from the initial 3.0%.

Let’s recall that Q1 showed a negative contraction (-0.5%), mainly due to higher imports and trade policy uncertainty. This upward revision shows that the U.S. economy is not only weathering the uncertainty, but continues to expand at a solid pace.

What drove this revision? Stronger consumer spending and higher investment. Despite tariffs and uncertainty, U.S. consumers remain resilient. And as long as employment stays strong and layoffs limited, this momentum has the foundations to continue. Encouragingly, this growth is not “inflated” by government spending but supported by the real economy.

THE FED’S PLANS

Now the big question: What will the Fed do?

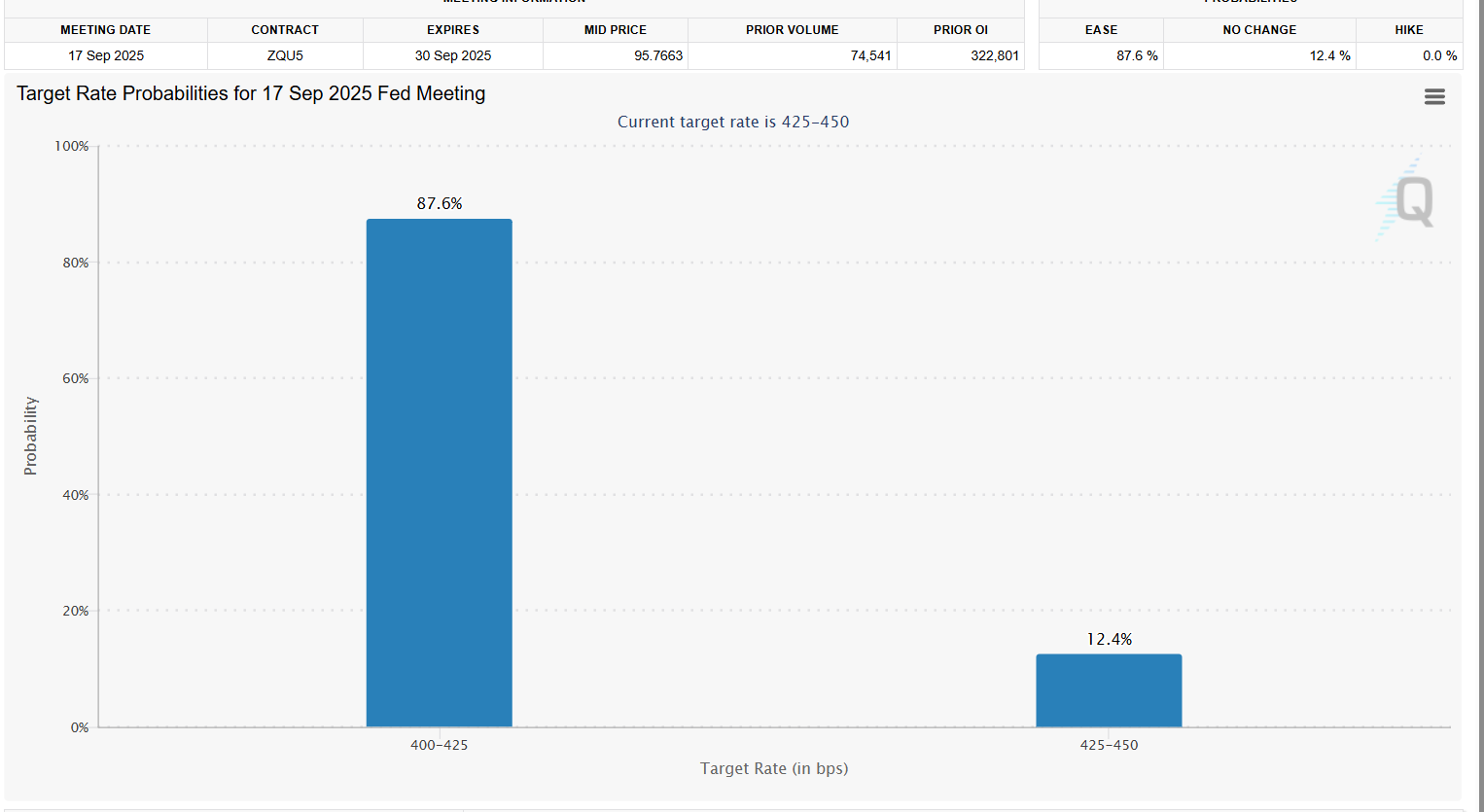

According to the FedWatch Tool, the odds of a rate cut at the September meeting have jumped to an impressive 87.6%!

This is one of the highest probability readings we’ve seen in months (so close to the next meeting), and it clearly shows that the market EXPECTS action. Some analysts are even talking about potential cuts in October and December, if this dynamic continues. So we shouldn’t rule out any scenario. For now, though, it looks like the conditions are aligning for the Fed to begin gradual rate cuts.

INVESTMENT TAKEAWAYS

So, what should we expect going forward?

Here’s the picture: (a) Tariffs will likely start having a more visible impact on consumption in the coming months. Early signs are already appearing in some sectors, but the full effect will show next quarter. (b) Inflation, while still above the Fed’s target, shows no signs of accelerating. The stability in July’s Core PCE suggests things remain under control for now—and that’s the most important point. (c) Household spending and income continue to grow steadily, confirming that the U.S. consumer is still willing to spend, especially when spotting value and discounts. (d) Markets appear to have already priced in expectations for rate cuts.

P.S. The most crucial numbers will be those from the last months of the year, but with what’s happening at the federal statistics agency, I just hope we won’t see “cooked” figures.

Posted Using INLEO