Overnight, nearly everyone in the house got sick with a flu, so the plans for the day got cancelled and might be for the weekend also. Still, I am "functioning", but I can definitely feel the discomfort building in my body, so I will try to get some thoughts out prior to implosion, just in case. Though, I do tend to "test" writing under lots of conditions, to see what comes out. Sometimes it is comprehensible, sometimes it is rubbish - so let's see what this will be today, with a fever.

---

---

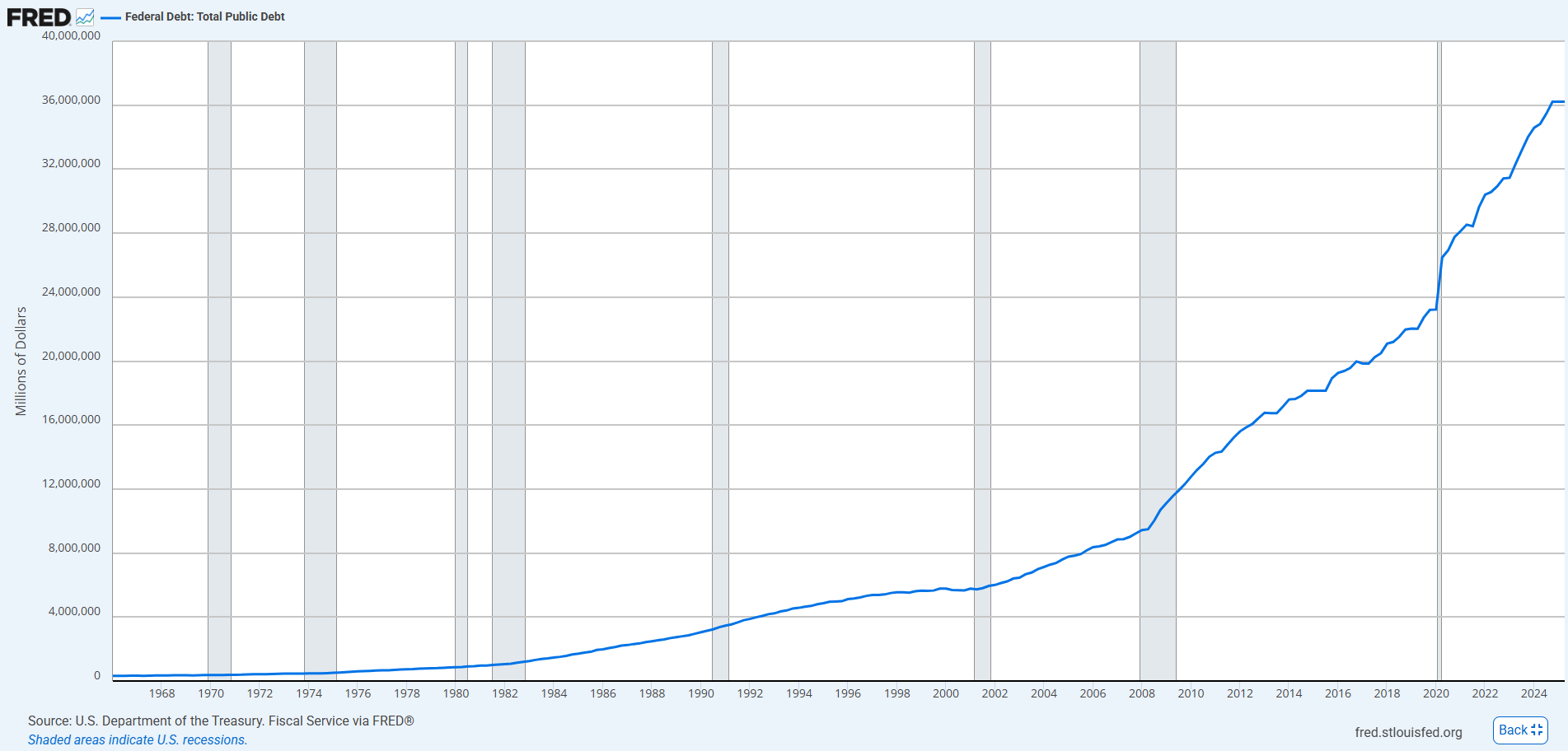

I used this graph the other day which depicts the US public debt growth over time from almost zero, to about 37 trillion today.

Why this is important to pay attention to in my opinion, is that it shows how policy shifted into "increase shareholder wealth" and away from what took the average American, and indeed the average global citizen, forward. This increase in public debt is a mechanism to borrow from the future to line the pockets of the minority now, effectively forcing tax payers and everyone else who isn't increasing their wealth at the same rate to finance the few.

This has allowed the US with 5% of the population, to "grow" their economy to be 30% of the global total, funded almost entirely by debt. However, being the largest single consumer market, comes with concessions and benefits in global control, as well as discounts on all things, meaning that with this power, they are able to command the rest of the world to come into line with them, forcing hands, and taking advantage of markets. For instance, with all the trade tariff talks back and forwards, *services* are not being brough into question, because these are *massive* for the US. Just imagine if Apple and Amazon had to pay their taxes where the money was earned. For instance in Australia, Apple generated 9B in revenue, but paid less than 140M in tax in the country. That is almost the entire amount leaving Australian shores. Where does it go?

> To increase shareholder wealth.

That is the metric of business since the early 70s. However prior to this, businesses still felt some duty of care toward the community, meaning that it wasn't an outright maximisation of profit strategy, there was *a little* more balance. Especially in a globalised world where a head office for a trillion dollar company can be a post office box in Delaware, duty of care for a community has eroded to nothing, because the profits are coming in from all over the globe, with no single community, let alone one that the average company CEO lives within.

But as we know, this is unsustainable, because ultimately the wealth gap collapses the system. As I said the other day, while stock values have increased 300% in the last couple decades, wage growth has only increased 50%. This means that while people can buy less from the companies, the companies are still increasing their values. This is because the investors keep investing, pushing up the value of the companies, even though the companies themselves aren't able to maintain that kind of consumer demand required to justify the evaluation. Eventually, it has to collapse.

Yesterday a client was talking about how he sees young people (he is in his 60s) driving around in cars and having houses that he doesn't think they can afford, and wonders how much of it is on a credit card. A lot and it is growing. This credit spending of course allows for demand on goods and services using resources from the future, just like the US government has done to pad pockets now. The problem comes when the over extension happens, and it can't be paid back.

For instance, imagine your neighbour upgrades their home to something really fancy, buys a Ferrari and a new boat, and goes on a lot of holidays suddenly. The assumption is that they won the lottery or something. But if it is on credit, eventually the creditors will send around the guys with baseball bats. They will lose what they have, and still be in debt, right?

However, think about it at a country level where the same thing has happened, but instead of just the nation losing its stuff, there is a global network of industries that have all aligned themselves to the overconsumption of goods and services that were buying on debt. This is essentially what is happening with the US now, and the rest of the world doesn't want to stop supplying the US debt mindset, because we have aligned ourselves to making money from that model. This is why the "When the US sneezes, the rest of the world catches a cold" is true.

It is a very, very poor strategy from the rest of the world to tie itself to the obviously unhealthy economic model of the US, yet it has been the way a few people have been able to become extremely wealthy and create an illusion of some kind of economic stability. But, that stability falls down once the debt model is no longer serviceable.

As I have said many times before now, the rest of the world needs to ween itself off the debt addicted US in order to sell goods, and build up a diverse set of markets to account for the disruption or complete loss of the US market. The rest of the world really only needs to increase its own consumption of "something" by about 4% in order to replace the entire US economy. That *something* can be anything really, but it would be great if it was something that was useful for building a healthy society, rather than maximising wealth.

Despite all the bravado, the US economic model is increasingly fragile because it relies on the illusion of wealth through lines of credit in order to maintain its control. Ultimately, the stability of the nation is going to come down to its people and their ability to cope in what is becoming a rapidly untenable political and economic environment at the global level. The US can't shut itself off from the world because it needs the rest of the world for goods and services, but more importantly, those discounted profits coming in from the globalised companies that get pushed to generate shareholder wealth. If those taps get closed, the US economy falters massively.

The profit from useless consumption has a ceiling on it, but the desire for infinite return on investment does not. This means that eventually, especially because people won't be able to afford to consume, the reality of the markets will force a massive devaluation of all of these companies that were previously able to attract massive investment wealth. With no demand coming in, where does the profit keep coming from? It is a bit like Tesla selling large numbers of cyber trucks to other Musk businesses. It doesn't add up to good business.

The move to shareholder wealth at any cost, means that business and community are no longer tied together. Before, businesses would provide for the community, and the community would provide for the business. It was part of the symbiotic relationship. Yet, even though there is still the practical need for that relationship on both sides, the corporate side has been able to change the rules of the contract to continually reduce its responsibility for the community. That means that in the quest to increase shareholder wealth, they can take more from the community than they offer back.

> It is a doomed relationship.

If the countries are going to be using debt, what they should be doing with it is encouraging people to spend on wellbeing activities, encouraging people to be more human, more dynamic, more community focused in their consumption to drive the kinds of demand that makes life better. The businesses that should be incentivised are the ones that take us forward as a species, not the ones that harm us. But, that is not what has been happening for the last fifty years, where instead of improving wellbeing, we are now in contraction, because we have got to a point where to increase wealth further, we have to take away from people's improved lives.

>All that public debt was spent on enriching the few.

And here we are, in a world that has people who are closing in on being trillionaires, while the majority of the global population is finding it harder and harder to survive in the current economy. The thing is though, this is exactly what the economy has been built to do, because that is the inevitability of tying the success of business to the accumulation of wealth, rather than the accumulation of health.

> Debt well spent?

We are all going to catch a cold.

Taraz

[ Gen1: Hive ]

---

**Be part of the Hive discussion.**

- Comment on the topics of the article, and add your perspectives and experiences.

- Read and discuss with others who comment and build your personal network

- Engage well with me and others and put in effort

**And you may be rewarded.**

---

Everyone Catches a Cold

@tarazkp

· 2025-10-17 14:30

· Finance and Economy

#finance

#economy

#philosophy

#psychology

#mindset

#family

#health

#wellbeing

Payout: 0.000 HBD

Votes: 342

More interactions (upvote, reblog, reply) coming soon.