A lot is happening within the traditional financial arena regarding crypto. The hybrid system is rapidly forming, one where crypto is deeply ingrained into present operations.

Last week, the headlines discussed how Michael Saylor's Strategy (MSTR) was not added to the S&P500. Many felt this was going to happen. Now, the company will have to wait until the next rebalancing in December.

What was added, however, was Robinhood. While this is not exclusively a crypto company, it did make great strides regarding its low cost, crypto trading platform that garnered a lot of users. In fact, along with Coinbase, it is the leading destination for crypto traders in the United States.

This is part of a larger move where banks are starting to enter the crypto space. Stablecoins were a major boost, something that could be outpaced by real world assets. DeFi is gaining more attention as the rails keep expanding, allowing traditional firms to tap into them.

In this article we will look at Robinhood and what this could mean.

Robinhood Added To S&P - Crypto Entering Mainstream

The addition to the S&P is not a crypto move. Realistically, this is traditional finance at its best.

For those unaware, the S&P500 is a weighted index that is suppose to mirror the impact of companies on the economy. It is constantly readjusted as certain industries have a greater impact.

Since crypto is becoming a growing component, the index is looking at getting that represented. It is why many thought MSTR would be added.

Robinhood is a safer bet because it is expanding its business in both crypto and equities.

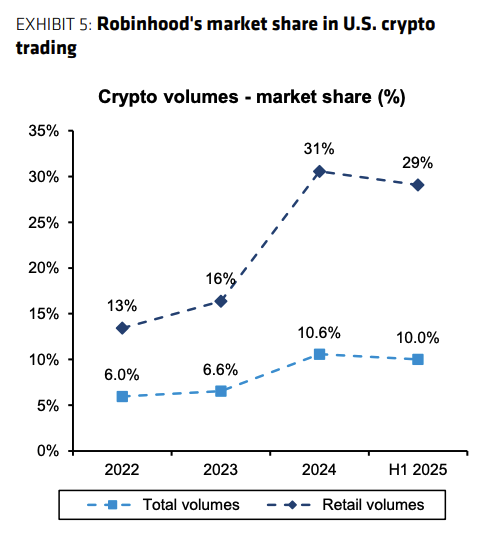

Bernstein estimates Robinhood controls 12% of the U.S. retail trading revenue market across equities and crypto, up from 7% just two years ago. Its spot equity trading market share has increased from 2.8% in 2023 to 5.5% in 2025, while its equity options dominance has more than doubled since 2023, accounting for 24% of retail volume. Crypto retail trading has become another key driver, with Robinhood's market share surging to around 30% following the collapse of FTX and Binance.US's retreat from the country.

The crypto, naturally, is where people are focused. At present, the company is near 30% of the US crypto trading market.

Coinbase gets a lot more of the attention but Robinhood is a legitimate player.

The Merging

Crypto and TradFi are rapidly becoming one. We are looking at integration occurring in a way where distinction between the two isn't possible.

What does tokenization mean?

Let us look into this for a moment.

If we have the tokenization of a real world asset such as a bond, what are we dealing with. It is obvious that bonds are traditional finance, going back centuries. Tokenization is a new process, allowing for greater efficiency.

So what is a tokenized bond; traditional finance or crypto?

Does this clarify what is happening? We are seeing the traditional players, such as Blackrock, bringing out products which are the tokenization of traditional assets. Actually, a case could be made that stablecoins fall into this category also, tokenizing a combination of treasuries and bank deposits.

Mike Novogratz, head of Galaxy, recently tokenized the stock (GLXY) on Solana. This was a big move since it is SEC-registered, Class A common stock. It simply allows the moving of the stock from traditional exchanges to onchain.

Naturally, for a company such as Robinhood, this means the stock could be traded both in the form of tokens or traditional shares.

Wall Street is changing things up quickly. This is what happens when the behemoths enter the arena.

Posted Using INLEO