Should you buy $LEO or $LSTR?

This is a question that many are considering. There are proponents on both sides of the discussion. Frankly, if the ecosystem keeps growing, adding more value, there is no wrong answer.

In other words, both assets will perform well.

However, is one better than the other? Many will point to $LEO, the base token for the platform. This is the foundation of all that is being built.

It is hard to argue against something this fundamental. After all, we are conditioned in crypto to look in this direction. After all, when we look at networks, aren't BTC and ETH the plays?

We are entering a new era in crypto. The options that people have are expanding. Much of this is due to Wall Street entering, bringing out an assortment of products.

Leo is following the same path. Here is where the non-accredited investors can seek to make some bank.

In this article I will try to answer the $LEO or $LSTR debate.

LSTR Is The Leo Play

We only need to look at the original Bitcoin treasury company, Strategy, to see where this is going. It also answers why the title is "LSTR is the Leo Play".

When we look at the returns over the past 5 years, few will outpace Bitcoin. This is true no matter what long term period we look at (10 or 15 years show the same). That said, there is one that surpassed the return on BTC, and by a fairly significant margin.

This is the company formerly known as Microstrategy.

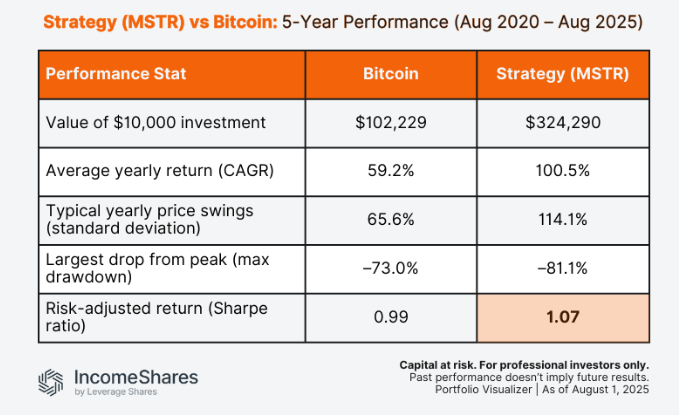

MSTR has usurped BTC in terms of the growth in price over the past 5 years. The following table explains this clearly.

As we can see, a $10K investment in Bitcoin in August 2020 would be worth $102K, basically a 10x. However, the same money in MSTR would be worth more than 3 times that, topping $324K.

In other words, $30K would make one close to a millionaire. Of course, this is only a 5 year return. What happens over the next 5?

Leverage Is Key

The reason why MSTR can outperform is leverage. Michael Saylor's approach is to keep adding BTC to the balance sheet, growing the number of coins held while also enjoying the higher USD price.

In other words, each share of MSTR, over time, ends up holding more BTC. This is why the price will eclipse that of BTC.

So what about Leo?

Since Leostrategy is following a similar model, we can see how it is likely to do the same. Like BTC, LEO is now capped, at 30 million tokens.

The key to this entire concept is revenues. Leostrategy is already operating a couple of different applications from which it derives revenues. This is a big step since it can add to the holdings.

Remember, the number of LSTR is capped at 100K (for now). This means that any LEO which is added to the balance sheet sends the Leo per LSTR upwards. In other words, it is only a matter of the pace which it happens.

One major revenue stream that is about to enter is the sLEO staking. Since USDC is earned on each LEO staked, Leostrategy is in position to benefit. Each USDC will be used to buy LEO, further increasing the holdings.

An important component to this is the fact that the percentage of USDC earned by Leostrategy will grow over time. Some will earn USDC and opt to spend it on other things. LSTR is only adding to the Leo/LSTR metric, something that is crucial for people to watch.

This is why outsized gains as compared to the underlying metric is there. People, by holding LSTR, are basically leveraging their LEO position.

Another revenue stream that is arriving in the near term is the market marker approach. Here is where Leostrategy will basically trade volatility. This has proven a winning formula in different markets. Now, every LSTR holder is going to benefit since the revenue generated will be used to add more LEO to the balance sheet.

To me, the idea is to consider what this looks like with 10-15 revenue streams. Each time something is built by Leostrategy, there is, at minimum, a management fee. @lstr.voter is a prime example.

Each revenue stream drives more money in, causing the LEO/LSTR to increase. Add in new sources such as SURGE or collateralized lending and we can see how this metric could explode over the next 6 months.

Eventually, this will show up in the price of LSTR. It is why the true play is not LEO but LSTR. That is where the outsized market capture will accrue.

Posted Using INLEO