Welcome back,

We are just three days away from the FOMC meeting and today the US Consumer Price Index (CPI) data was released. The previous CPI was at 2.7%, the expected was 2.9%, and we actually got 2.9% only. This is bearish for the market because when CPI data goes up, it means higher inflation, and in such cases the FEDs are more likely to hold the rates so now there arise a question on whether Fed will still cur rates or not.

In March 2025, the CPI data showed 2.3%, which means the inflation was at 2.3%. The Fed generally targets 2% inflation rate, after which the rate cuts are more likely to happen. But despite the US CPI data coming higher this time at 2.9%, I still think there is a lot of hope of getting a rate cut in the next few days. One of the most important reasons for that is the US jobless claim data.

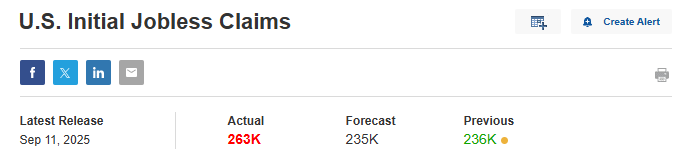

The weekly jobless data for the US was expected to be around 235k, while the actual came out to be 263k, which is actually quite a lot compared to the expected jobless claim. Now this is something that is going to force the Fed decide about rate cuts because they can’t afford more jobless people in the country.

So I think that even after the US CPI data coming at 2.9%, the chances of rate cuts are still very high. I still believe that rate cuts are going to happen in the next three days, and once that happens, the market will boom after that.

The market today has not shown any significant move, and Bitcoin is slowly climbing close to its $115000 resistance. I think we are going to see it breaking that resistance very soon, especially if rate cuts happen in the next three days. In that case, both Bitcoin and other cryptocurrencies are going to move up.

I have also recently shared about how most of the tokens are now trading at the resistance of the last five years. Now, that is something very important to look at because once that resistance is broken, the market is going to expect a massive pump, first in the mid-cap tokens and then later in the altcoins that are being held by the retailers.

So what are your thoughts on the US CPI data which came out today? Do you think the Fed will pause the rate just because of this data? Personally, I don’t think this data will have a bigger impact on the decision of rate cuts because there are many other factors which I believe will force the Fed this time to cut the rates by at least 25 BPS. But only in the next few days we are going to know what will really happen.

If I go with the speculation, the speculations are already at 99% in the favor of rate cuts. So let’s see what happens in the next few days, there is not much time left. I will request all the traders to not get involved in futures right now because there is a high chance of getting liquidated in this phase as the market can get very manipulative in the next few days.

Thank you and happy trading everyone.

Posted Using INLEO