Another typical example of why decentralization is important in the cryptocurrency world just unfolded. When the tokens of one of the early major investors into World Liberty Financials were frozen without any reason, the fight between centralized control and true financial freedom has been once again highlighted.

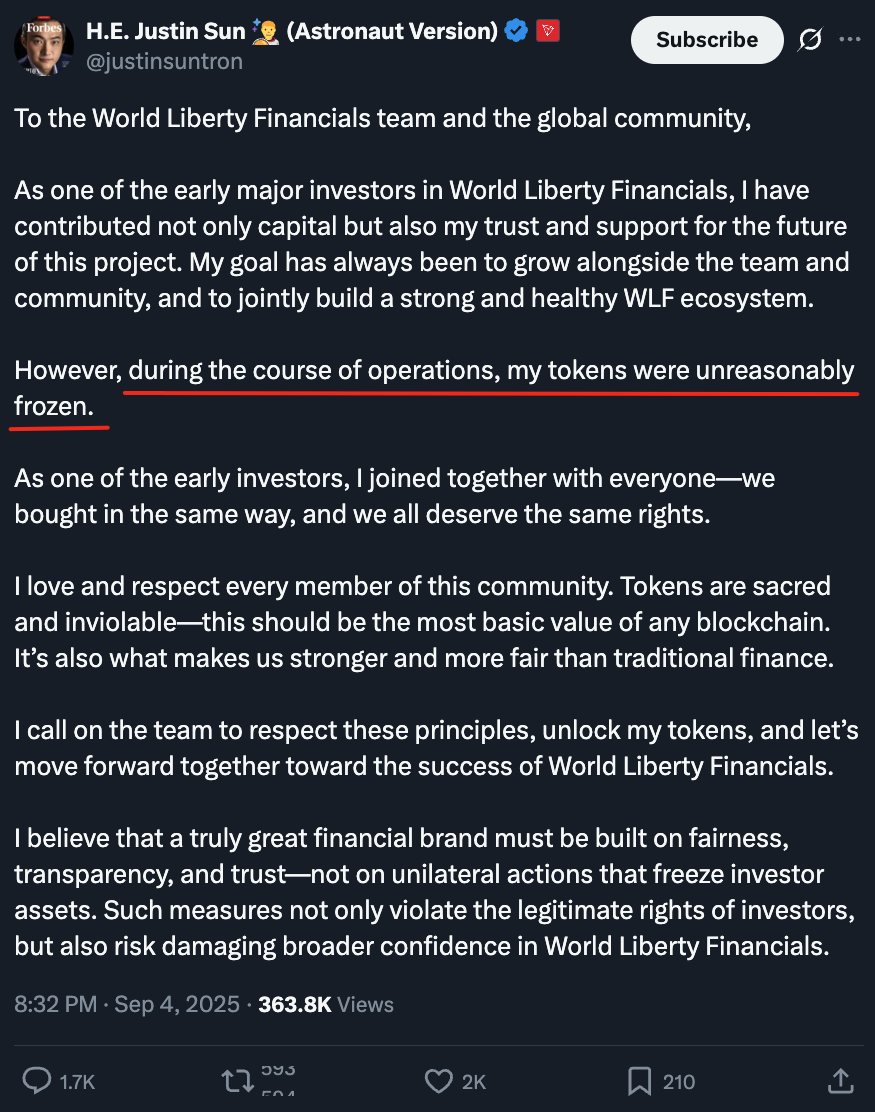

In a report to the World Liberty Financials team and the global community, one of the project's earliest major investors, Justin Sun, informed that his tokens had been mysteriously and unreasonably frozen. It was not only a small investor that this happened, rather someone that had put a lot of money and energy into the future of the project.

The event unravels an uncomfortable paradox in the crypto space. The investor, in this instance, is the one that bought alongside, only those tokens were frozen while the others stood safe. With this action, the project has violated the whole idea of technology behind the blockchain.

One of the main features of blockchain technology is the idea of tokens as one of the most important and the most secure things in the system. This is not one of the usual crypto jargon- it is the most basic argument that the blockchain is more just and strong than the traditional financial system. When projects breach this provision, it is not only individual investors they are hurting - they are also damaging the whole ecosystem's trustworthiness.

What makes the situation even worse is that there is a total breach of the rights of the investors. All those who invested in World Liberty Financials have the right to be treated in the same way. No one is allowed to arbitrarily freeze tokens in a system that is based on fairness and transparency.

One of the hallmarks of a successful financial brand, especially in the blockchain area, is that it should lean heavily on the three aspects of prevailing: fairness, transparency, and trust. Actions that are taken unilaterally to freeze investor assets contravene these principles. In addition to great individual investors, the trust that is the entire project’s strength is also being eroded.

The main idea that is coming through the incident is: the very existence of centralized control over assets that are supposed to be decentralized is a patent contradiction. In case the project teams are given the liberty to freeze tokens at their will, then, by that act, they are bringing back the same types of power imbalances that blockchain technology was created to overcome.

The incident is like a cold shower for the entire crypto community, making them rethink their attitude. The investors must demand that they are offered various safeguards. The commitment of the projects to decentralization needs to be strong. The community must be seen and felt that it is firmly united in facing and confronting the enemy.

The way leading to the future is not invisible. World Liberty Financials ought to adhere to these fundamental concepts and loosen the frozen tokens. Thus, by sincerely committing to the investors’ rights and fair treatment, they can regain the trust of the public and be successful in their future.

The effect of this incident on the wider crypto community is that it continues to reinforce the importance of the lesson: that the aspect that differentiates the project from others is not just the technical feature but the fact that it is a fundamental attribute of the financial system, which should be fair and trustworthy. In case the project compromises on this principle, it is tantamount to their cloaking the very future they hint at.

The finance of tomorrow will have to come from real decentralized, where the rights of the token are fundamentally secure and no investor is treated unfairly. Slightly lowering the bar is not only a step backward - it is also an abandonment of the revolutionary promise of blockchain technology.

Posted Using INLEO