Hey Hivers,

It's been a while since I've made a good 'ol fashioned Macro post about the state of the market. 2025 has been about as choppy of a year as I expected. As we entered Q4, it was anyone's bet as to where we would be, but there was a sense of cautious optimism. There are a lot of things all converging at once, and it has created a lot of noise.

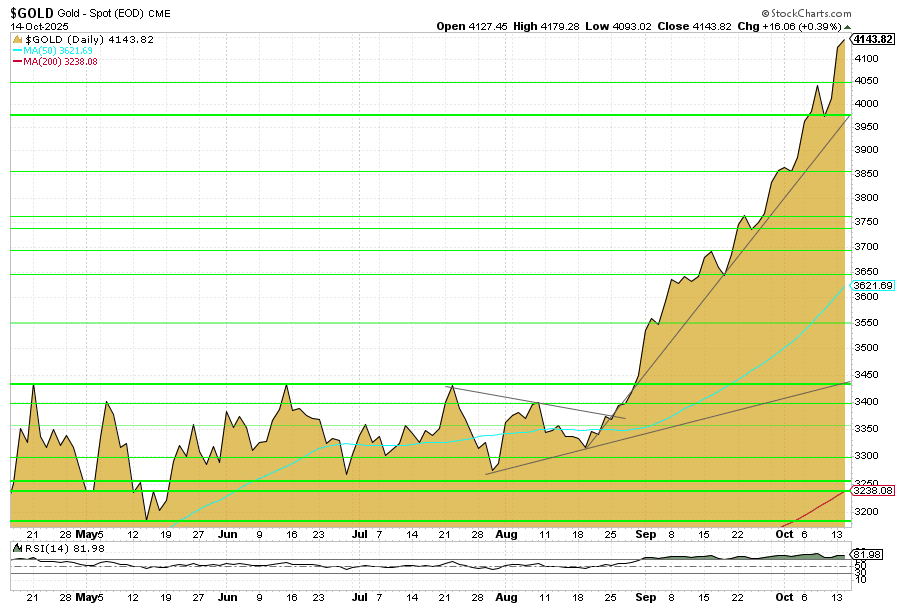

Before I mention where I think we are now, I'll lay out the thesis that I have been carrying all year: Currency Debasement will be the theme of the year playing into 2026. Precious Metals will run, and the Global Financial system will pivot to Blockchains as a way of Revolutionizing the monetary system, using stable coins as a way of propping up demand for Fiat Currencies.

In the simplest of terms, I expected Gold to run up throughout the year. Then The Fed/Treasury would revalue the Gold Reserves, add a few Trillion of Dollars to the Balance sheet, and then use that to reverse QT and expand their own balance sheet. This would coincide with a restart of the rate-cutting cycle and an eventual pump in Risk assets that would likely manifest in November and run until mid-December before the steam runs out and the entire house of cards comes crashing down.

What had been becoming increasingly apparent the past years was that lending had gotten out of control since the pandemic. Private Equity's greed has built up a timebomb that will eventually blow and it will likely be the thing that tanks the entire Equities and Crypto market. What Saylor has been doing with Microstrategy has been done in many industries. All of the AI spending has been absurd. OpenAI announcing 100 Billion dollar deals when their valuation is like 300x their annualized revenue. And this is before we take into account the massive Energy bills that will need to be financed once all these data centers come online. It's all crazy.

Then you have to throw the Tariffs into the mix. If Covid taught us anything, it is that there is NO WAY you can cause that much disruption in global supply chains without triggering inflationary pressure. A lot of households had paid down their debts after receiving stimulus checks, but since 2022, we have seen the credit default risks rise steadily. You can't just levy a massive tax increase like that and not expect average households not to get squeezed. It was always coming, but there has been plenty of credit to keep absorbing the hits before the last bit of air gets pushed out of the bubble.

It all sounds so bearish, where does that leave us now? I'm not going to sit here and say that I feel super confident, but I still believe that the thesis remains intact and believe there is a good chance we will see a blow-off top style rally into December. It seems insane after everything that's happened the past 7 days, but the reality is that Pullbacks like the one we are experiencing now often proceed the final rally as Leverage is flushed out and loads of people throw up levered shorts. That is the Powder that fuels the explosive rallies to the upside with the right catalyst.

And what might that be? Rate cuts are coming. ETFs are launching. And the Fed and Chinese Central bank are both likely to intervene to avoid Credit Crises and dump liquidity on the market. People forget that the 2008 financial crisis first showed signs in mid-2007, but the fed stepped in and poured gas on the market and that is what caused the parabolic rally.

There will be calls (like always) that we're in a Super Cycle. And it is from that position, that we will see the market break down and the Fed won't have any tools left to save it. But with Powell having announced the end of QT, and with 2 more rate cuts this year all but guaranteed, I'm not ready to reject the Thesis and pack it in for a prolonged bear-market. Will that come? Yes I believe it will, but sometime in 2026 and not Q4 2025.

IF we see sustained closes below the 200 MA on Bitcoin and Ethereum, I think that would confirm the rejection of this Thesis, but for now I believe there is still a good chance we have one last big run into the end of the year. Think about it, how many times have we heard Crypto Twitter flip to extreme bearishness and call the end of a Bull Market only to have Bitcoin Jolt back to life and go parabolic. One might even say that this move was expected, and I'll admit that buying here feels terrifying, but when I revisit my thesis from the start of the year, I expected to be buying at a period when everyone was screaming it's over.

What do you think? Are we entering Crypto-Winter and witnessing the start of a pretty savage recession, or are we kicking the can down the road and riding the wave on a Year ending Pump?