LEO Staking Rewards Are Live

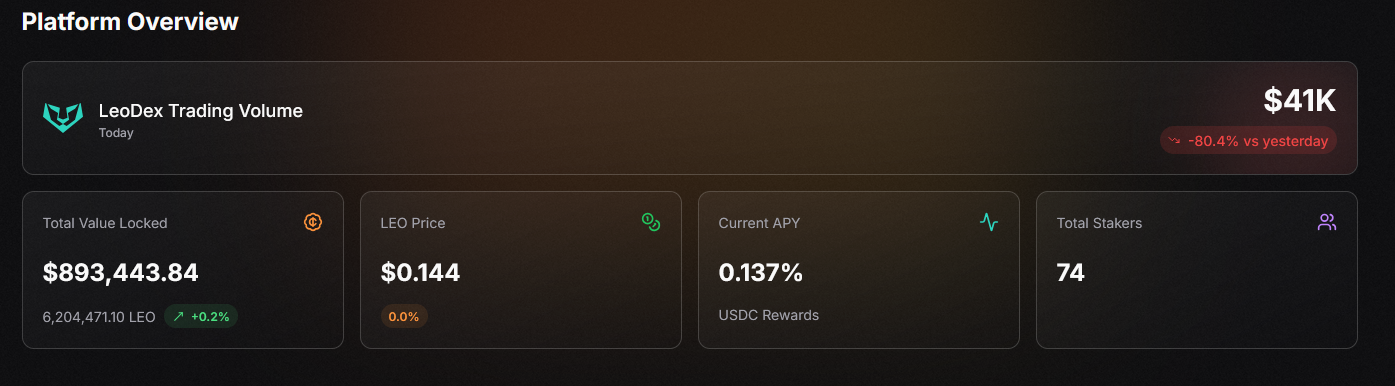

After 2 weeks I wanted to give a bit of a review for how things are going. Rewards went live on September 23rd and we have seen quite a bit of volatility. On average I would say that the DEX gets around $100-$200k volume each day with a big outlier some days ago with $7M+! There are now (only?) 74 stakers and over 6M LEO staked with a TVL of almost $1M. Not bad. But it's interesting that we have seen such a slow development in terms of staking LEO on the Dex. One reason as mentioned before is that bridging LEO comes with a big caveat. There is a fee of around 12-13% when brdiging LEO from HE to ARB... This has personally disincentivized me from moving my LEO there and I am sure it has for other holders. The better way potentially is to sell LEO for Hive and then buy LEO on ARB again. I wanted to make a guide on this, but my HIVE is currently stuck on BeeSwap.

Crazy Returns?

If you have been in the DeFi game from last cycle you might be accustomed to 1000%+ APYs from staking rewards. This of course was only possible because the token was highly inflationary and overall this hasn't really worked out for most in the long run. With LEO being deflationary and rewards being payed out in USDC the game is different. We can't really expect crazy returns. But how high are they atm?

To cut to the point: they are not very high. In fact, it's really quite low. I had expected something like 10-15%, but for now it seems that it is far lower. Here is an overview of some of the key metrics. Notice that we get the APY right on the dashboard, but I think this is calculated for the day and is not an average value (if not, let me know):

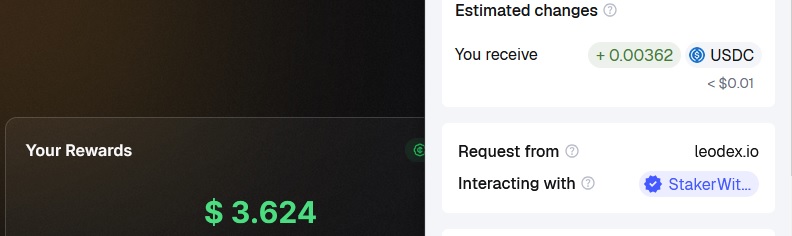

Personally, I staked 100 LEO on September 30th and now after 6 days I can see the return for that period. First, there is a UI issue for the rewards, the decimals are 3 points off. I was eligible to claim 0.00362 USDC.

So how much APY is that?

0.00362/6 = 0.000603

0.000603 * 365 = 0.2202

So around 22 cents after a year... With a 100 LEO being worth around $14 atm this makes up for an APY of around 1.6%

Not exactly amazing.

However

- This is based on 6 days of data

- Volume could increase by several multiples if the dex keeps gaining traction

But then again only 20% of LEO has been staked, so there still is a lot of dilution possible.

Conclusion

With LEO being a deflationary asset, we shouldn't expect some crazy APY returns. That's okay. But for the moment we can see that the returns for staking LEO are also very low indeed. I guess like always this is a conviction game: do you truly believe in LEO? Does the team have what it takes to keep the dex at the forefront of DeFi? If yes, then the APY is only going to grow and keeping it staked on the dex will eventually pay off.

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

⛅🌦🌧🌦🌧🌨☁🌩🌦⛅🌧☁🌤🌥🌪🌧🌨🌩⛅🌦☁🌤🌥🌤⛅🌤⛅🌦⛅

Check out the Love The Clouds Community if you share the love for clouds!

⛅🌦🌧🌦🌧🌨☁🌩🌦⛅🌧☁🌤🌥🌪🌧🌨🌩⛅🌦☁🌤🌥🌤⛅🌤⛅🌦⛅