September 23rd draws nearer

I believe this is the date when staking rewards will go live for LEO token holders on https://leodex.io

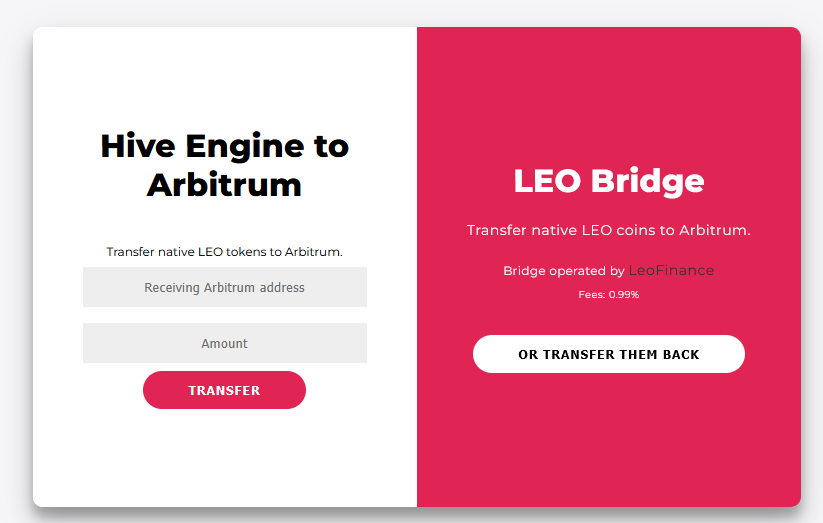

If you hold some Leo and perhaps held them for some time, this will be a great opportunity to make use of the tokens. If you are holding them on Hive-Engine you will have to bridge. You can do this on https://wleo.io/leo-arbitrum/ Note that transferring them back to HE has a fee of 0.99% (not super great), but at least you can get them on ARB for free.

With Leo 2.0 we have seen a parabolic move for LEO recently and fortunately price has recovered since it dipped to around 10 cents. A price reversal makes sense if many are speculating on getting staking rewards in a couple of weeks. The Leo/Hive ratio is now back into the 0.6s again. Note: if you are delegating your HP to leo.voter, you should be aware that current APR is around 6-8%.

So what can we expect?

First the stats which you can find here: https://leodex.io/leo

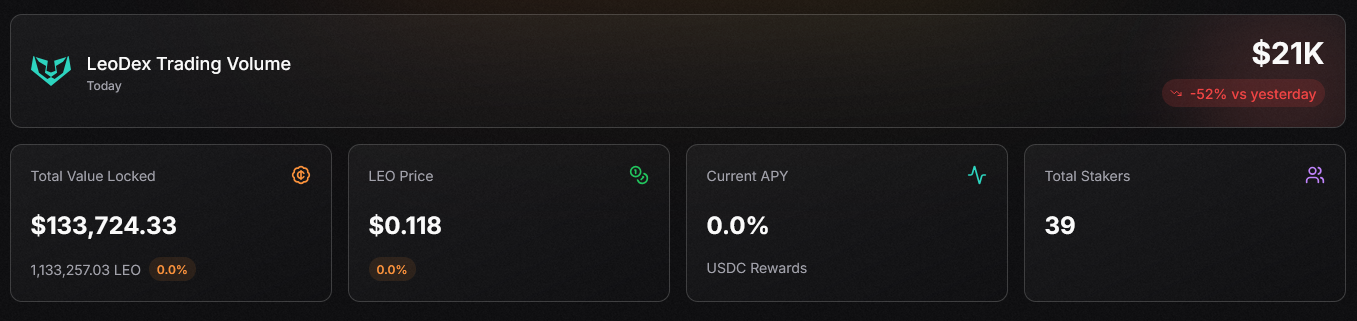

There is around 1.1M LEO staked atm and comes from only 39 stakers.

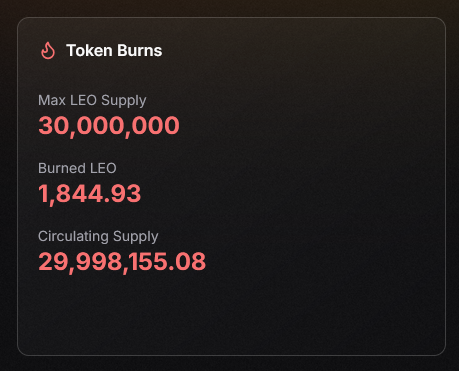

Overall we have a 30M hard cap for LEO of which 99% is in circulating supply.

So what is the revenue for the Dex?

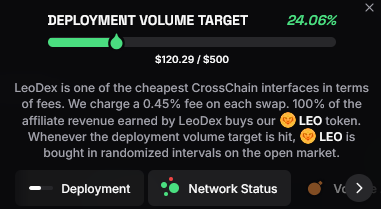

We can see that volume is very volatile atm with around $21k traded today. Apparently it was closer to around $50k yesterday and I believe it has been 6 figures in the past. If I am not mistaken, the fee for the Dex is 0.45% and 100% of it will go to sLEO stakers.

Unless I am missing something it would then seem that today's (not yet completed) revenue is:

21 000 * 0.45% = $95

The caveat here is that I don't really have an average to work with. Is it $200? It is clear to me, however, that the team has managed to get noticed on X and the crypto community. LeoDex is often spotlighted among the top Dexs in the Thorchain/Maya etc. community. So I wouldn't be surprised if volume keeps increasing. I think the team has at one point aimed for a 2.7k target.

If the amount of LEO staked doesn't change (which it will of course) until September 23rd this would mean that someone holding 10k LEO would receive around:

10 000 / 1 100 000 = 0.009

0.009 * 95 = $0.86

Is that good or bad? And how much LEO can we expect to get staked?

I doubt it will remain at around 1M since this calculation seems to be much too profitable for not more users to stake their tokens. Again, this will be on the low end of things.

10k LEO costs around $1200 atm so it would be an APR of around:

0.86 * 365 = $314

314 / 1200 = 26%

I have a feeling that the APR will settle between 5-10%, but since both ends of the equation are dynamic (LEO staked and Volume) it is difficult to throw around any meaningful numbers.

Conclusion

If LeoDex doesn't get at least 10M LEO staked I would be surprised. It will of course depend on the APR, but that will be quite volatile I guess. The other use case for LEO is to stake it on HE and get curation rewards on InLeo. I suppose this will keep LEO in both places (which is good).

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

⛅🌦🌧🌦🌧🌨☁🌩🌦⛅🌧☁🌤🌥🌪🌧🌨🌩⛅🌦☁🌤🌥🌤⛅🌤⛅🌦⛅

Check out the Love The Clouds Community if you share the love for clouds!

⛅🌦🌧🌦🌧🌨☁🌩🌦⛅🌧☁🌤🌥🌪🌧🌨🌩⛅🌦☁🌤🌥🌤⛅🌤⛅🌦⛅