We knew it would come, but still...

It feels surreal at this point to see the market falling like this when there is only like 2-3 months left for the cycle. ALTs got completely hammered today and it just doesn't feel like a bull market whatsoever. BTC has had its run and the only thing missing is the last parabolic move to the top. Most ALTs, however, are near their all time lows! Even large coins have seen a poor performance with only ETH making considerable gains recently. If this bull market only favored the few and we don't get an all up season this is going to be like max pain^2. But I can't see a 80-95% bear market starting in 2026. It just can't happen if no big money entered the market, right? Because if it does, then 90% of crypto projects are going to be a thing of the past.

Just 3 days ago we had the best BTC September on record.

https://x.com/coinbureau/status/1968808503000150160?t=bYwR8QYa1tBI5MervW8D_g&s=19

I guess people shouldn't call the month early.

Cycle Shift?

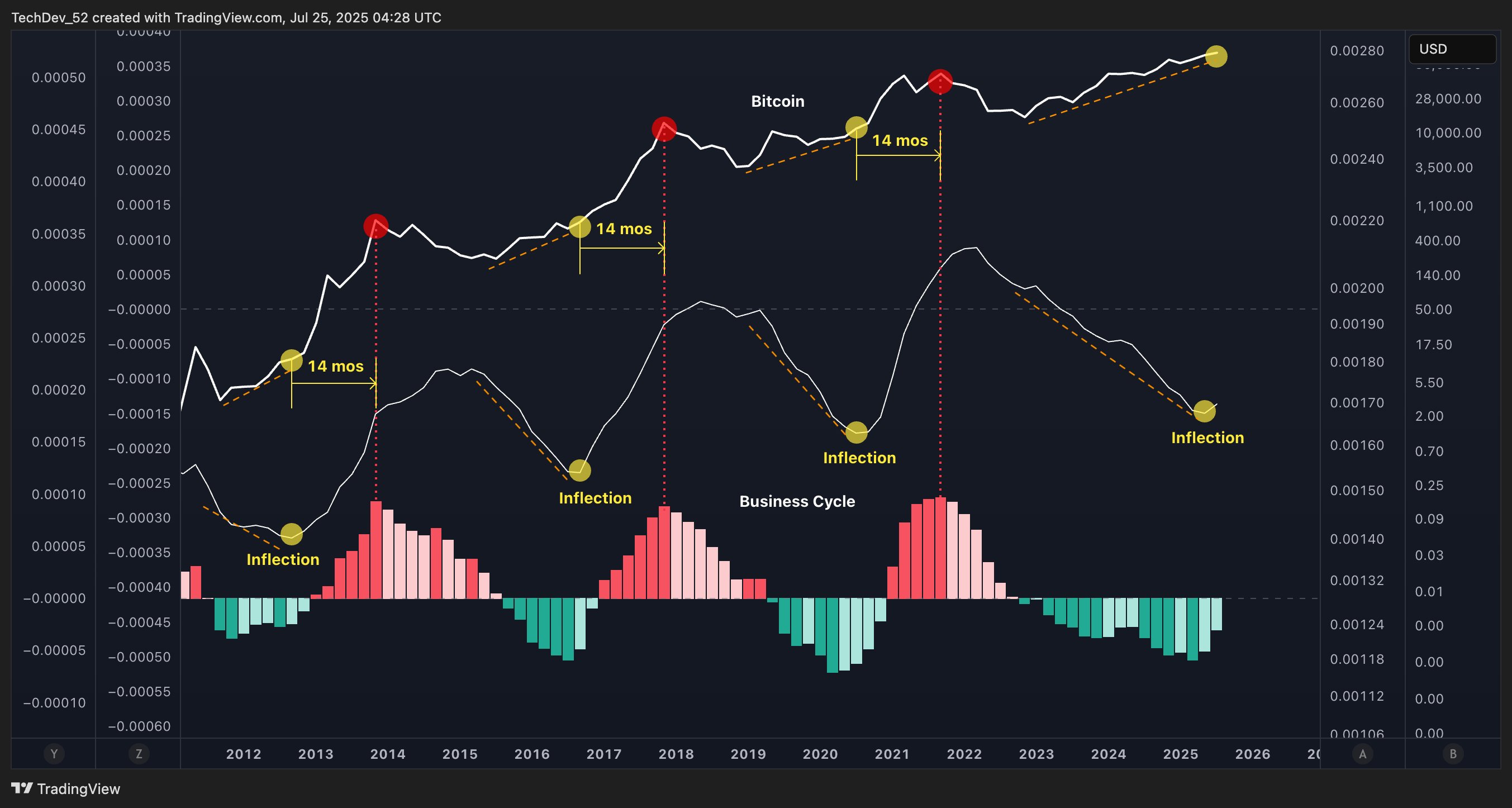

I feel much is pointing to a cycle shift in crypto overall. If 2026 is the start of a 3 year long bear market, ALTs should historically give up 90-95% of their gains. But with many ALTs being barely up from their ATLs, where does that leave the market? Can we really assume that the 4 year cycle will last forever while the halving event becomes less and less important? I feel that at one point a deviation seems more realistic. While BTC has performed quite well in this cycle, we can now also observe a deviation from a classic blow off top pattern. Someone on X has recently posted this chart which looks interesting and seems to suggest that the peak is no where close.

https://x.com/TechDev_52/status/1948826445251281392?t=tjl8b4vYOAgZp23V1tIKIg&s=19

According to Grok what we see here is this:

The second derivative is based on Bitcoin's price data (likely log-transformed), measuring the rate of change in its momentum to highlight inflection points where acceleration shifts. The business cycle refers to the global business cycle, derived from economic indicators like liquidity trends, expansions, and contractions (e.g., OECD data), which TechDev correlates with BTC cycles.

If so, the peak would be more likely in Q3/Q4 of 2026... Is that heretical to suggest? In a way yes, but again, the cycle ending in Q4 of 2025 is questionable as well.

Conclusion

I am getting tired of crypto. The strategy of selling everything for short term gains seems to have been the superior one for the last years. Hodling hasn't really been rewarded. But perhaps if more people feel like this, a delayed shift to 2026 with people capitulating is exactly what we could expect from a rational market and irrational market players.

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

⛅🌦🌧🌦🌧🌨☁🌩🌦⛅🌧☁🌤🌥🌪🌧🌨🌩⛅🌦☁🌤🌥🌤⛅🌤⛅🌦⛅

Check out the Love The Clouds Community if you share the love for clouds!

⛅🌦🌧🌦🌧🌨☁🌩🌦⛅🌧☁🌤🌥🌪🌧🌨🌩⛅🌦☁🌤🌥🌤⛅🌤⛅🌦⛅