KEY FACTS: MicroStrategy, the world’s largest corporate Bitcoin holder, launched November by acquiring 397 BTC for $45.6 million at an average price of $114,771, bringing its total holdings to 641,205 BTC (valued at over $73 billion) with a year-to-date Bitcoin yield of 26.1%, while LeoStrategy, a Hive blockchain-focused investment entity, quietly added 6,461 LEO tokens across November 1 and 2, boosting its balance to 3,701,031 LEO (approximately $430,633.7) to strengthen the value of the LEO token as well as the LEO Per Share (LPS). Together, these strategic buys by the two “Strategy” firms - one a Wall Street titan betting on digital gold, the other a Web3 native nurturing decentralized finance- signal continued institutional and community conviction in their respective blockchain visions amid a market seeking momentum after October’s slowdown.

___

Source: Bitcoin Strategy, Leo Strategy

___

# Bitcoin and LEO Strategy Companies Kickstart November with 397 Bitcoin and 6,000 LEO Buys

Two entities sharing the “Strategy” moniker have made decisive opening moves in November, reinforcing their divergent yet complementary visions for digital asset dominance. MicroStrategy, the Nasdaq-listed software giant turned Bitcoin treasury juggernaut, disclosed a $45.6 million purchase of 397 BTC, while LeoStrategy, a blockchain-based capital vehicle operating within the LeoDex / INLEO / LEO token ecosystem, quietly accumulated approximately 6,000 LEO tokens over two days to fortify its balance sheet and LEO accumulation footprint.

These parallel acquisitions (one executed through SEC filings and convertible debt firepower, the other tracked via transparent on-chain balance sheets) highlight a maturing market where corporate giants and community-driven DAOs alike are doubling down on their chosen protocols, betting that sustained accumulation will power the next leg of the bull cycle.

Michal Saylor's Strategy acquisition, disclosed in a U.S. Securities and Exchange Commission (SEC) filing on Monday, marks the company's first major buy of November and pushes its total holdings to a staggering 641,205 BTC, valued at a cumulative cost of $47.49 billion. At an average purchase price of $114,771 per coin for this latest tranche, the deal reflects Bitcoin's volatile yet upward trajectory in recent weeks. Strategy's year-to-date Bitcoin yield now stands at an impressive 26.1%, a testament to the firm's aggressive accumulation playbook that has transformed it from a traditional analytics provider into one of the world's largest corporate holders of the pioneering cryptocurrency. Saylor, the company's co-founder and executive chairman, has long positioned Bitcoin as "digital gold" and a superior store of value against fiat currencies, a philosophy that has propelled MicroStrategy's stock to new heights even as broader markets grapple with uncertainty.

___

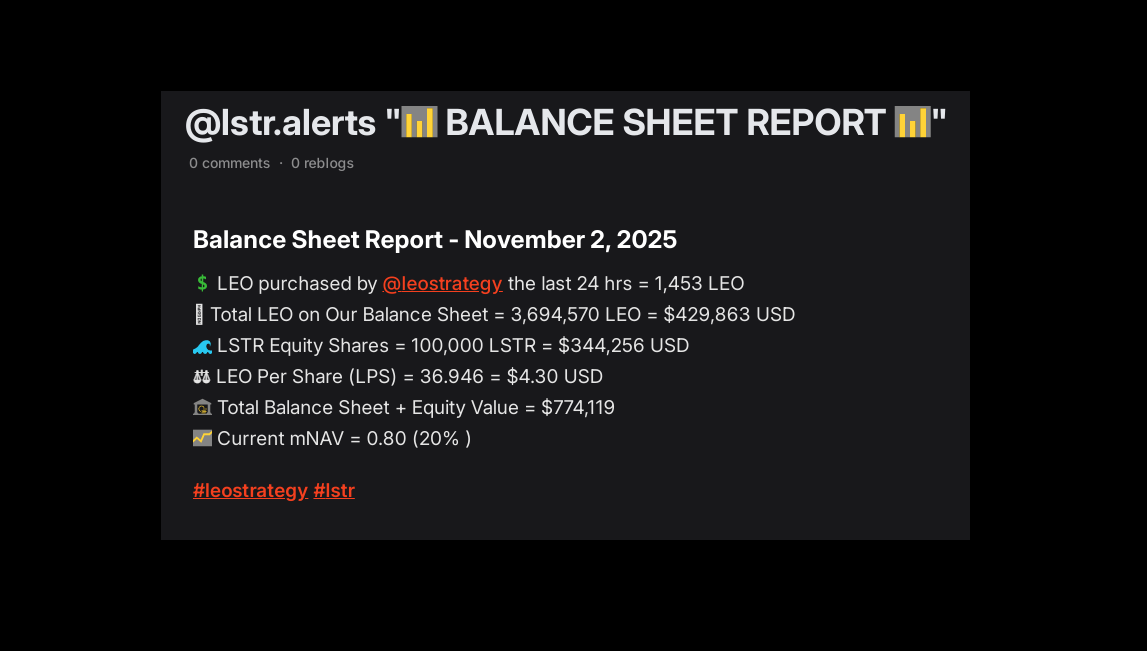

source: LSTR Alerts - November 2 LEO Buy Report

___

In a parallel universe of blockchain innovation, where decentralized ecosystems thrive beyond Bitcoin's towering shadow, Leo Strategy buys LEO following its Time-Weighted Average Price (TWAP) Program; the transactions are published on Hive blockchain through the INLEO microblogging interface through the @lstr.alerts handle, after each transaction is completed. LeoStrategy has methodically bolstered its balance sheet with an additional 5732 LEO tokens on November 1, 2025, to the time of this publication. Momentary transparency reports as of November 2 show holdings 3,694,570 LEO tokens valued at $429,863. November 3 purchases tracked in 9 transactions total 3664 as at 5:37 UTC+1, bringing the total LEO holdings to 3,701,031, valued at $430,633.7. $LEO, the native utility token of the ecosystem, powers content monetization, premium access, and AI agents and DeFi realities on LeoDex.

This purchase arrives hot on the heels of October's relatively subdued activity, where Strategy added just 778 BTC to its coffers at a total cost of around $86.6 million. That monthly total—split across two buys of 390 BTC for $43.3 million in the final week of the month and the earlier September spillover- represents one of the lightest accumulation periods in the company's recent history. For context, September alone saw the firm acquire 3,526 BTC, a volume 78% higher than October's haul, fueling speculation that Strategy was front-loading its buys ahead of potential regulatory or market headwinds.

The slowdown has not gone unnoticed by market watchers. As Bitcoin's price hovers around $115,000 (recovering from a mid-October dip but still shy of its all-time highs) analysts are linking the cryptocurrency's momentum directly to institutional heavyweights like Strategy and U.S. spot Bitcoin exchange-traded funds (ETFs). According to data from analytics platform CryptoQuant, these two forces have been the primary engines driving demand throughout 2025, accounting for billions in inflows that have buoyed BTC against macroeconomic pressures like inflation concerns and geopolitical tensions.

Nearly two weeks ago, LeoStrategy unveiled its first on-chain Real World Asset (RWA) token, TTSLA, a synthetic Tesla stock designed to offer 24/7 market access, yield, and transparency for modern investors. Built on both Hive-Engine (Hive's L2) and Base Blockchain, TTSLA tracks Tesla’s price at a 1:100 ratio and is overcollateralized by permanently staked LEO tokens on LeoStrategy’s balance sheet. Unlike traditional algorithmic pegs, it employs a monetary rate policy to maintain correlation with TSLA, offering a baseline 3% daily yield that is adjustable weekly. Yield payments began for the tokenized Tesla stock (TTSLA) three days ago across both Hive-Engine (HE) and Base blockchain, marking a major milestone in its real-world asset tokenization initiative. The yield, currently offering over 30% APR, is distributed daily at midnight EST, with random snapshots taken six hours before to prevent system gaming. Early presale participants enjoy 2x yield for 60 days and benefit from a Dutch Auction-style mechanism.

As November unfolds, the twin strategies of MicroStrategy and LeoStrategy crystallize a pivotal truth that the future of digital assets will be shaped not by one chain or one token, but by a spectrum of conviction, from Saylor’s monolithic BTC fortress to LeoStrategy’s yield-rich, community-governed mosaic. For both Strategy companies, accumulation remains the ultimate vote of confidence in a borderless financial order. In the end, as balance sheets grow heavier.

Information Sources:

- [Bitcoin Strategy SEC Filing](https://www.sec.gov/ix?doc=/Archives/edgar/data/0001050446/000119312525261714/mstr-20250902.htm)

- [Strategy Announcement/ X](https://x.com/Strategy/status/1985331547432464542)

- [LSTR Alerts - November 2 LEO Buy Report](https://inleo.io/@lstr.alerts/balance-sheet-daily-20251102-1762118998)

- [LSTR Alerts - November 1 LEO Buy Report](https://inleo.io/@lstr.alerts/balance-sheet-daily-20251101-1762032574)

- [LSTR Alerts - November 3 (Latest) LEO Buy Report](https://inleo.io/@lstr.alerts/alert-1762187616)

- [Cointelegraph](https://cointelegraph.com/news/michael-saylor-strategy-november-45m-bitcoin-buy)

- [leostrategy TTSLA Yield payments/ InLeo](https://inleo.io/@uyobong/leostrategy-begins-yield-payments-for-ttsla-pioneering-realworld-asset-tokenization-with-30-apr-2jy)

- [LeoStratey TWAP Program/ InLeo](https://inleo.io/@uyobong/leostrategy-to-launch-100000-twap-program-for-leo-token-glr)

---

___

_If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!_

## This post was created via INLEO. What is INLEO?

> [INLEO's](https://leofinance.io/) mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, [Inleo.io](https://leofinance.io), allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

---

---

### Let's Connect

Hive: [inleo.io/profile/uyobong/blog](https://inleo.io/signup?referral=uyobong)

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

---

Posted Using INLEO