KEY FACTS: Bank Negara Malaysia (BNM) has launched a three-year roadmap to pilot real-world asset tokenization, co-led with the Securities Commission Malaysia through the Asset Tokenization Industry Working Group (IWG) and the Digital Asset Innovation Hub (DAIH), focusing on high-impact use cases such as supply chain financing for SMEs, tokenized MYR liquidity management, Shariah-compliant Islamic finance automation, green bond and carbon credit tokenization, and 24/7 cross-border trade settlements; the initiative emphasizes interoperability, security, and regulatory clarity, with a public discussion paper open for feedback until March 1, 2026.

___

Source: Bank Negara Malaysia

___

# Malaysia's Central Bank Charts Three-Year Path to Asset Tokenization

Bank Negara Malaysia (BNM), the nation's central bank, has unveiled a comprehensive three-year roadmap to pilot the tokenization of real-world assets. This strategic initiative, announced on Friday, promises to transform everything from supply chain financing to cross-border trade, blending cutting-edge blockchain technology with Malaysia's robust financial ecosystem. As global regulators race to harness the power of digital assets, Malaysia's plan signals a proactive embrace of tokenization, not as a speculative venture into cryptocurrencies, but as a practical tool to enhance efficiency, inclusivity, and sustainability in the economy.

The roadmap's launch comes amid a surge in interest across Asia in asset tokenization, in which physical and financial assets such as real estate, commodities, and securities are converted into digital tokens on a blockchain. This process allows for fractional ownership, instant settlements, and programmable smart contracts, potentially unlocking trillions in illiquid assets worldwide. For Malaysia, a nation already renowned for its Islamic finance leadership and growing fintech scene, the initiative represents a natural evolution. It builds directly on the earlier establishment of the Digital Asset Innovation Hub (DAIH), a collaborative platform designed to foster experimentation and regulatory sandboxes for emerging technologies.

The BNM's strategy is centered on the creation of the Asset Tokenization Industry Working Group (IWG), a high-level body co-led by the central bank and the Securities Commission Malaysia (SC). This group will serve as the nerve center for coordinating industry-wide efforts, pooling expertise from banks, fintech firms, and legal experts to explore tokenization's potential. The IWG's mandate is clear: to identify and prioritize use cases that deliver "clear economic value," while tackling thorny regulatory and legal hurdles head-on.

A BNM spokesperson emphasized in the announcement, saying, that tokenization holds immense promise for our financial sector, but it must be grounded in real-world benefits and robust safeguards. This underscores a cautious yet optimistic tone of the roadmap. The working group's initial focus will be on foundational pilots, ensuring that innovations align with Malaysia's economic priorities, such as bolstering small and medium-sized enterprises (SMEs) and promoting green initiatives.

The country has long been a pioneer in Islamic banking, which accounts for a significant portion of its financial services. BNM's roadmap explicitly nods to this heritage by prioritizing Shariah-compliant applications, where tokenization could automate complex transactions that currently rely on manual processes. For instance, smart contracts embedded in tokens could enforce profit-sharing models or ensure ethical investments, streamlining operations while upholding religious principles.

The three-year timeline is structured to transition from exploratory proof-of-concept (POC) projects to full-scale live pilots, all orchestrated through the DAIH. While exact milestones remain flexible to accommodate feedback, the roadmap outlines a series of targeted applications that could redefine key sectors:

- **Supply Chain Financing**: One of the most immediate priorities is using tokenized assets to unlock credit for SMEs, which form the backbone of Malaysia's economy. The tokenizing of invoices or inventory could help businesses to access instant liquidity without the delays of traditional lending. This could be a game-changer in a country where SMEs contribute over 30% to GDP but often struggle with cash flow.

- **Tokenized Liquidity Management**: Financial institutions stand to benefit from faster, 24/7 settlement systems. Tokenized deposits in Malaysian Ringgit (MYR) would enable real-time transfers, reducing counterparty risks and operational costs. BNM is particularly keen on studying MYR-denominated stablecoins to maintain the "singleness of money", the principle that a unit of currency holds uniform value across the system, while integrating these with wholesale central bank digital currency (CBDC) explorations.

- **Islamic Finance Automation**: Tokenization could revolutionize Malaysia's $1 trillion Islamic finance industry by embedding Shariah rules directly into digital assets. Programmable payments, for example, might automatically distribute zakat (charitable giving) or ensure compliance with riba (interest) prohibitions, cutting down on administrative burdens.

- **Green Finance and Sustainability**: In line with global climate goals, the roadmap highlights tokenizing carbon credits or green bonds. This would facilitate transparent tracking of environmental projects, attracting international investors to Malaysia's burgeoning sustainable finance market.

- **Cross-Border Trade Settlements**: Perhaps the most ambitious element, 24/7 tokenized settlements could slash the time and cost of international trade. By linking with regional partners, Malaysia aims to create seamless corridors for exports, vital for an economy heavily reliant on commodities like palm oil and electronics.

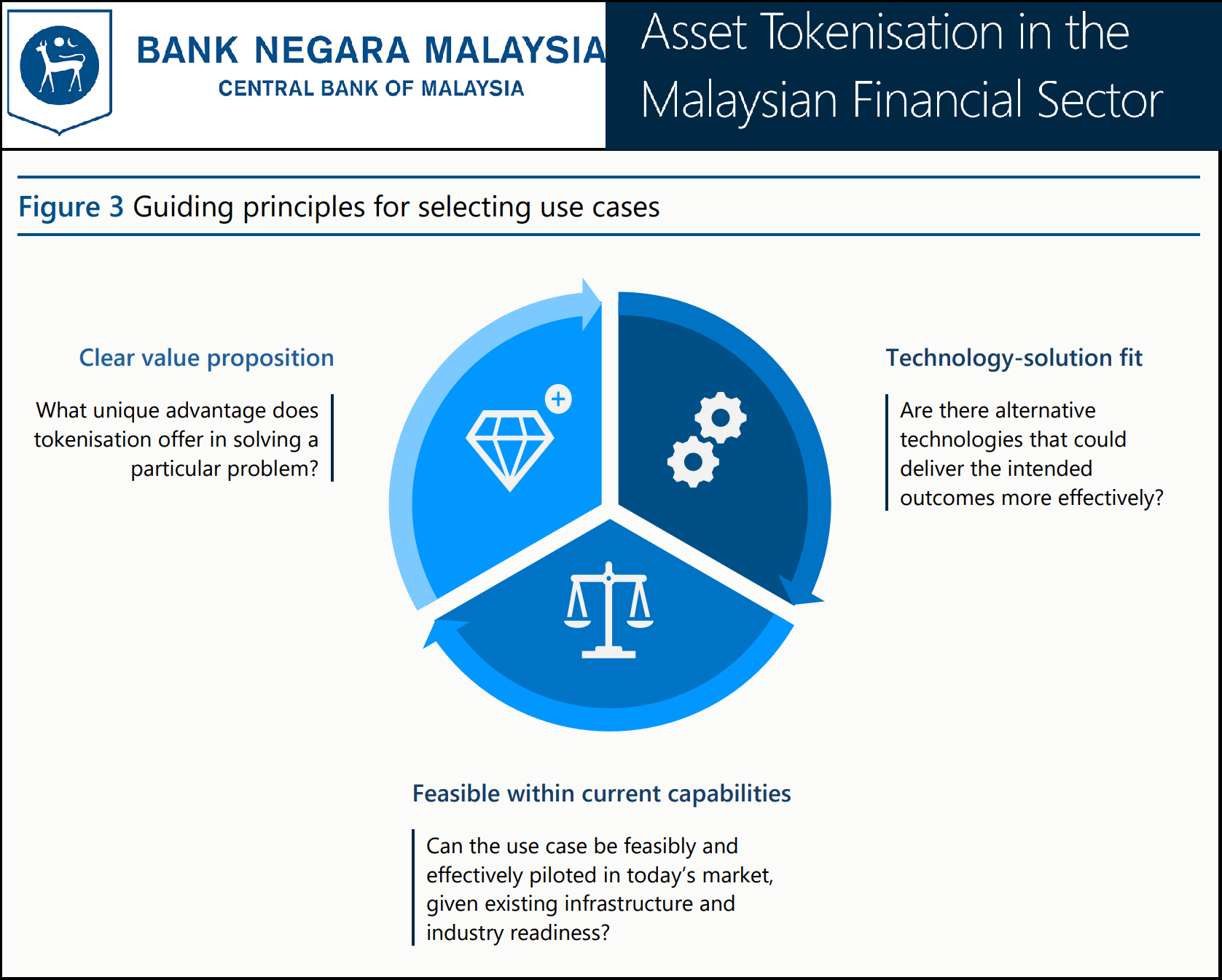

These use cases are guided by a set of principles outlined in BNM's accompanying discussion paper, which emphasizes interoperability, security, and consumer protection. The paper, available for public and industry input until March 1, 2026, invites stakeholders to shape the pilots, ensuring the roadmap evolves with practical insights.

Technically, the pilots will leverage distributed ledger technology (DLT) to represent assets as tokens, often using standards like ERC-1400 for security tokens. BNM envisions hybrid models where public blockchains handle transparency and private ones ensure privacy for sensitive financial data. Integration with CBDC prototypes (Malaysia has been testing digital ringgit concepts since 2021), will be a focal point, potentially enabling atomic swaps between tokenized assets and central bank money.

The roadmap positions the country alongside trailblazers like Singapore's Monetary Authority (MAS), which has piloted tokenized gold and carbon credits, and Hong Kong's Hong Kong Monetary Authority (HKMA), known for its e-HKD CBDC trials. These neighbors have demonstrated tokenization's viability: Singapore's Project Guardian, for instance, tested over $100 million in tokenized assets across borders, proving reductions in settlement times from days to seconds.

With these efforts, Malaysia could enhance ASEAN-wide interoperability, fostering a regional digital economy. Yet, the roadmap also acknowledges unique local needs, such as accommodating Malaysia's multicultural financial landscape, where Islamic finance coexists with conventional systems. Experts hail the initiative as timely.

Meanwhile, BNM has firmly reiterated that public education will be key, as tokenization's benefits must be communicated to wary consumers and businesses. The extended feedback period until March 2026 reflects BNM's commitment to inclusivity, allowing time for rigorous testing. Early POC projects are slated to kick off within the first year, with live pilots scaling up thereafter. Success metrics will include cost savings, adoption rates, and risk mitigation, all benchmarked against international peers.

The tokenization roadmap is a blueprint for a more agile, equitable economy. By 2028, when the three-year plan concludes, BNM envisions a landscape where SMEs thrive on tokenized credit, financiers operate with unprecedented precision, and green investments flow freely across borders.

Information Sources:

- [Bank Negara Malaysia](https://www.bnm.gov.my/-/dp-at)

- [Discussion Paper on Asset Tokenisation - BNM Doc](https://www.bnm.gov.my/documents/20124/938039/Discussion_Paper_on_Asset_Tokenisation.pdf)

- [Finance Feeds](https://financefeeds.com/malaysias-central-bank-unveils-three-year-asset-tokenization-roadmap/)

- [Cointelegraph](https://cointelegraph.com/news/malaysia-central-bank-roadmap-pilot-asset-tokenization)

---

___

_If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!_

## This post was created via INLEO. What is INLEO?

> [INLEO's](https://leofinance.io/) mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, [Inleo.io](https://leofinance.io), allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

---

---

### Let's Connect

Hive: [inleo.io/profile/uyobong/blog](https://inleo.io/signup?referral=uyobong)

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

---

Posted Using INLEO