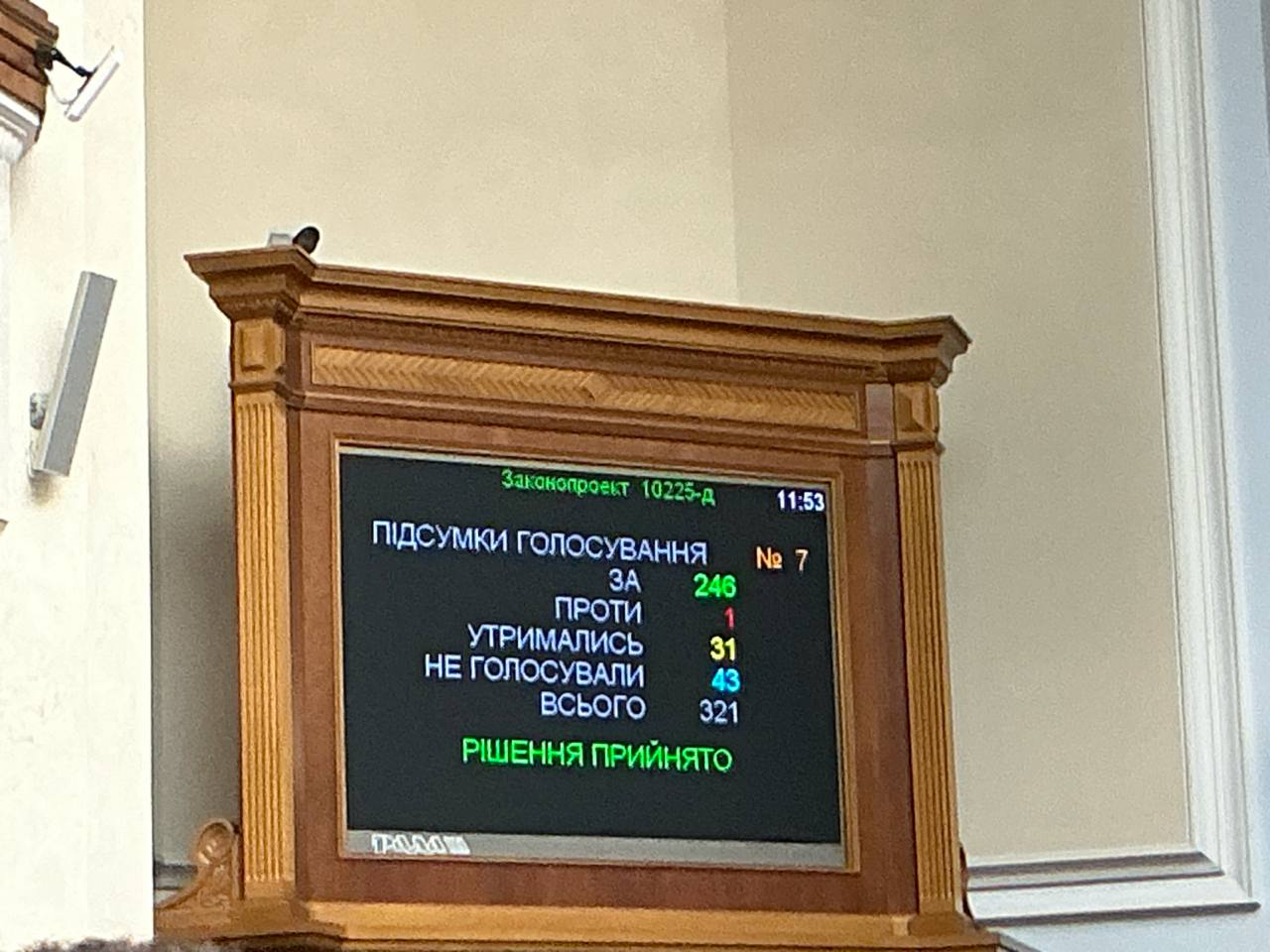

KEY FACTS: Ukraine’s parliament, the Verkhovna Rada, passed the first reading of a bill to legalize and tax cryptocurrencies, with 246 lawmakers voting in favour, signaling a major step toward integrating digital assets into the country’s financial system. The proposed legislation introduces an 18% income tax and a 5% military tax on crypto profits, with a temporary 5% tax rate on fiat conversions in the first year to encourage adoption, while exempting crypto-to-crypto and stablecoin transactions. Further readings and refinements are needed before the bill becomes law, potentially by 2026, with the National Bank of Ukraine or the National Securities and Stock Market Commission likely to oversee implementation.

___

Source: Ukraine Parliament

___

# Ukraine’s Parliament Backs Crypto Legalization and Taxation Bill

The Verkhovna Rada, Ukraine’s unicameral parliament, voted on Wednesday to support a bill that would legalize and tax cryptocurrencies, marking a significant step toward integrating digital assets into the country’s formal financial system. The bill, which passed its first reading with 246 lawmakers in favour, is poised to reshape Ukraine’s crypto sector, where the nation already ranks among the global leaders in adoption. This legislative development signals Ukraine’s ambition to become a regulated hub for digital asset trading in Eastern Europe, potentially attracting significant investment and fostering economic revitalization amid ongoing challenges.

The bill, known as the “Crypto Legalization and Taxation Bill,” outlines a comprehensive framework for regulating and taxing cryptocurrency transactions, aiming to provide legal clarity and bolster investor confidence. According to lawmaker Yaroslav Zhelezniak, who announced the bill’s progress on a Telegram channel, the legislation garnered strong support in its initial reading, reflecting a growing recognition of the importance of digital assets in Ukraine’s economy. If signed into law, the bill is expected to legitimize the crypto industry further, aligning Ukraine’s regulatory framework with international standards and positioning the country as a crypto-friendly jurisdiction.

Ukraine’s high ranking in global cryptocurrency adoption underscores the significance of this legislative push. According to Chainalysis’s 2025 Global Crypto Adoption Index, Ukraine holds the eighth spot worldwide, excelling in centralized value received across both retail and institutional categories. The country also ranks highly in decentralized finance (DeFi) value received, a sector gaining significant traction in Eastern Europe. Between July 2023 and June 2024, the region saw crypto flows totaling $499 billion, highlighting the growing economic impact of digital assets.

The draft legislation proposes a taxation structure designed to integrate cryptocurrencies into Ukraine’s fiscal system while offering temporary incentives to encourage adoption. Under the bill, profits from digital asset transactions would be subject to an 18% income tax and a 5% military tax, resulting in a combined tax rate of 23%. This rate aligns with recommendations made by Ukraine’s financial regulator in April 2025, which sought to establish a clear and sustainable tax policy for the crypto sector. Notably, the bill includes a preferential 5% tax rate on fiat conversions during its first year of implementation, a measure aimed at easing the transition for crypto holders and encouraging the legalization of previously acquired assets.

The proposed tax framework also includes exemptions for crypto-to-crypto transactions and stablecoin trades, a move that brings Ukraine’s tax system closer to those of other crypto-friendly nations. These exemptions are intended to reduce the tax burden on active traders and foster innovation in the DeFi space, where Ukraine has already established a strong presence. Volodymyr Nosov, CEO of the European crypto exchange WhiteBIT, emphasized the potential economic benefits of the legislation, stating,

> “A window of opportunity has opened for attracting crypto investments and repatriating foreign assets of Ukrainian crypto enthusiasts. This is a key factor for revitalizing the economy and modernizing the market.”

Ukraine has a history of regulatory starts and stops in the crypto space, with significant milestones dating back to 2014 when virtual currency trades were restricted to registered financial institutions. In 2017, the National Bank of Ukraine (NBU) declined to recognize Bitcoin as legal tender, citing the need for robust regulation. By 2018, the Ministry of Economic Development and Trade initiated efforts to classify and legalize crypto-related activities, laying the groundwork for future reforms.

In 2021, the Verkhovna Rada passed legislation recognizing cryptocurrencies and allowing crypto firms to launch digital asset exchanges and secure banking partnerships. However, progress on taxation lagged until recent years. In 2022, the parliament legalized crypto exchanges, but comprehensive tax policies remained elusive. The current bill builds on these efforts, reflecting a more mature approach to regulation informed by consultations with the National Bank of Ukraine (NBU) and the International Monetary Fund (IMF).

Earlier this year, Ukraine’s parliament introduced a bill to establish a crypto asset reserve, a move that could see the country join a select group of nations, including the United States and Kazakhstan, with codified cryptocurrency reserves. According to BitcoinTreasuries.net, Ukraine is already the fourth-largest government holder of Bitcoin, with 46,351 BTC valued at approximately $5.4 billion. The proposed reserve bill, combined with the taxation framework, underscores Ukraine’s strategic vision to leverage digital assets for financial resilience, particularly amid the ongoing war with Russia.

The push for crypto legalization comes at a critical time for Ukraine, which has faced significant economic and geopolitical challenges due to the Russia-Ukraine conflict. Cryptocurrencies have played a vital role in supporting the country during the war, facilitating humanitarian aid, donations, and cross-border transactions when traditional banking systems faced disruptions. Legalizing and regulating digital assets could provide Ukrainians with a secure and regulated means to protect their wealth from inflation and access global financial markets.

The proposed legislation also aligns with broader economic reforms aimed at enhancing Ukraine’s financial credibility on the international stage. The adoption of a regulatory framework that complies with Financial Action Task Force (FATF) standards and European norm positions Ukraine as a potential hub for regulated digital asset trading in Eastern Europe. The NBU has emphasized the importance of maintaining monetary stability and preventing evasion of martial law restrictions, ensuring that the crypto sector operates within a robust regulatory environment.

___

SOurce: Yaroslav Zhelezniak/ Telegram

___

Ukraine’s move to legalize and tax cryptocurrencies mirrors similar efforts in other countries. In October 2024, Denmark’s Tax Law Council proposed taxing unrealized crypto gains, aiming to simplify its tax system. In June 2025, Brazil ended a crypto tax exemption and imposed a 17.5% flat tax rate on crypto gains as part of a broader effort to raise revenue. In the United States, lawmakers scheduled a hearing in July 2025 to discuss a framework for crypto taxation, reflecting a global trend toward integrating digital assets into mainstream financial systems.

However, not all jurisdictions are moving in lockstep. Morocco, which banned cryptocurrencies in 2017, is reportedly preparing to legalize all digital assets, with its central bank exploring a central bank digital currency (CBDC). These developments highlight the diverse approaches to crypto regulation worldwide, with Ukraine’s balanced framework of taxation and exemptions positioning it as a competitive player in the global crypto economy.

The bill’s passage through its first reading sets Ukraine on a path toward becoming a regulated crypto hub, with implications for investors, businesses, and the broader economy. The next steps in the legislative process will be crucial, as lawmakers refine the bill and address outstanding questions about enforcement and oversight.

---

---

---

Information Sources:

- [Kyiv Independent](https://kyivindependent.com/parliament-backs-draft-law-to-legalize-tax-virtual-assets-in-first-reading/)

- [Yaroslav Zhelezniak/ Telegram](https://t.me/yzheleznyak/14082)

- [Yahoo Finance](https://finance.yahoo.com/news/ukraine-parliament-passes-first-reading-102435792.html)

- [Cointelegraph](https://cointelegraph.com/news/ukraine-crypto-legalization-taxation-bill-first-reading)

---

___

_If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!_

## This post was created via INLEO. What is INLEO?

> [INLEO's](https://leofinance.io/) mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, [Inleo.io](https://leofinance.io), allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

---

---

### Let's Connect

Hive: [inleo.io/profile/uyobong/blog](https://inleo.io/signup?referral=uyobong)

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

---

Posted Using INLEO