KEY FACTS: The Federal Reserve is set to host a conference on October 21, 2025, to explore tokenization and payments innovation, as the market for tokenized real-world assets (RWAs) surges to a record $27.8 billion, driven by tokenized private credit and U.S. Treasury debt. The event will feature discussions on stablecoins, DeFi, and AI in payments, following the passage of the GENIUS Act in July 2025, which established a federal framework for stablecoin issuance and eased restrictions on bank involvement in crypto.

___

Source: U.S. Federal Reserve

___

# U.S. Federal Reserve to Host Conference on Tokenization and Payment Innovations

The United States Federal Reserve has announced plans to host a pivotal conference on payments innovation and tokenization, signaling a significant step toward integrating blockchain-based financial technologies into the mainstream financial system. Scheduled for October 21, 2025, the event comes at a time when the tokenization of real-world assets (RWAs) is experiencing unprecedented growth, with the on-chain value of tokenized assets reaching an all-time high of $27.8 billion, a staggering 223% surge since the beginning of the year, according to data from RWA.xyz.

The conference, announced by the Federal Reserve Board on Wednesday, will bring together industry experts, regulators, and thought leaders to explore how emerging technologies can reshape the future of payments. The agenda will feature panel discussions on critical topics, including the tokenization of financial products and services, the convergence of traditional finance and decentralized finance (DeFi), emerging use cases for stablecoins, and the intersection of artificial intelligence (AI) and payments systems. Fed Governor Christopher Waller, who has been a vocal advocate for innovation in financial systems, emphasized the importance of the event in a statement:

> “I look forward to examining the opportunities and challenges of new technologies, bringing together ideas on how to improve the safety and efficiency of payments, and hearing from those helping to shape the future of payments.”

The Federal Reserve’s focus on tokenization comes at a time of explosive growth in the RWA market, driven by increasing interest from Wall Street and the passage of key stablecoin legislation in July 2025. Tokenization, the process of representing real-world assets such as stocks, bonds, real estate, or commodities as digital tokens on a blockchain, has emerged as a transformative force in finance. Tokenized assets, which enable fractional ownership, enhance liquidity, and reduce transaction costs, are bridging the gap between traditional finance and the decentralized world of blockchain.

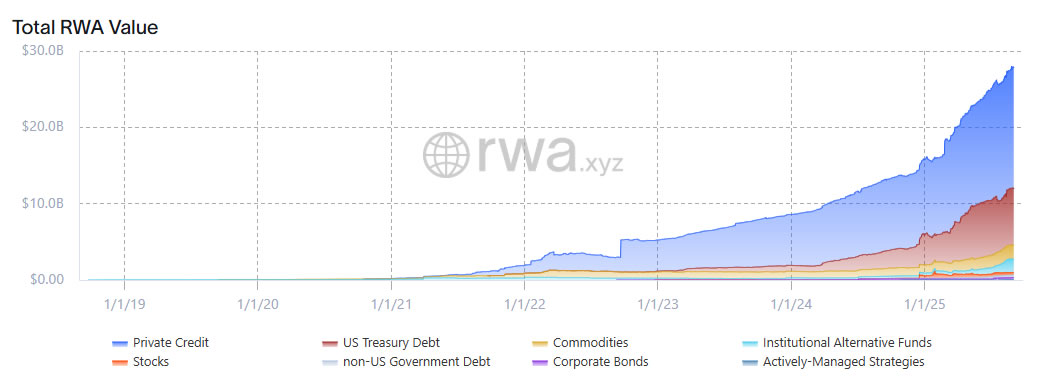

According to RWA.xyz, the on-chain value of tokenized RWAs has soared to $27.8 billion, with tokenized private credit and U.S. Treasury debt leading the charge. This growth reflects a 223% increase since January 2025, underscoring the rapid adoption of tokenization by institutional investors and financial institutions. The $400 trillion traditional finance (TradFi) market represents a massive opportunity for RWAs, with analysts predicting that tokenized assets could capture a significant share of this market in the coming years.

___

Total RWA value is at an all-time high. Source: RWA.xyz

___

The surge in RWA tokenization has been fueled by regulatory clarity, particularly the passage of the GENIUS Act in July 2025, which established a federal framework for stablecoin issuance in the U.S. The legislation requires stablecoins to be backed 1:1 by cash, deposits, or short-term Treasuries, providing a secure foundation for tokenized financial products. Additionally, the Federal Reserve’s decision to roll back previous restrictions on bank involvement in cryptocurrency activities has created a more favorable environment for financial institutions to explore tokenization and DeFi.

The Federal Reserve’s conference coincides with significant developments in the blockchain and tokenization space. This week, crypto oracle provider Chainlink announced a high-profile partnership with tokenization platform Ondo Finance to support its newly launched Ondo Global Markets RWA platform, dubbed “Wall Street 2.0.” The platform, which went live on the Ethereum blockchain for non-U.S. investors, brings more than 100 tokenized U.S. stocks and exchange-traded funds (ETFs) on-chain, offering global investors simplified access to these assets. The initiative, first announced in February 2025, marks a significant milestone in the integration of traditional financial instruments with blockchain technology.

Ondo Finance’s platform is part of a broader trend of blockchain-based innovation in finance. Ethereum remains the dominant blockchain for RWA tokenization, commanding a 56% market share for tokenized assets, including stablecoins, and over 77% when including Layer-2 networks, according to RWA.xyz. The platform’s ability to provide secure, transparent, and efficient infrastructure for tokenized assets has made it the go-to choice for institutions looking to enter the space.

Other notable developments include Anchorage Digital’s recent expansion of custody and staking services for Starknet’s STRK token, catering to institutional investors in the U.S., and Trust Wallet’s collaboration with Ondo Finance and 1inch to roll out RWA support on its self-custodial wallet. These initiatives highlight the growing institutional interest in tokenized assets and the infrastructure being built to support their adoption.

The Federal Reserve’s conference will also address the role of stablecoins, which have become a cornerstone of the tokenized asset ecosystem. Stablecoins, cryptocurrencies pegged to stable assets like the U.S. dollar, are increasingly being used in DeFi applications and as a medium for settling transactions involving tokenized RWAs. The passage of the GENIUS Act has provided much-needed regulatory clarity, encouraging major players like Circle (issuer of USDC) and Tether (issuer of USDT) to align with federal requirements. Circle, which recently applied for a national trust bank charter following its IPO, is positioning itself as a leader in compliant stablecoin issuance, while Tether continues to dominate trading volumes despite ongoing regulatory scrutiny.

The conference will explore emerging stablecoin use cases, including their potential to drive efficiency in cross-border payments and facilitate the growth of DeFi. Industry leaders like Galaxy Digital CEO Mike Novogratz have predicted that AI agents will soon become significant users of stablecoins, potentially leading to an “explosion” in transaction volumes. The integration of AI with payment systems, another key topic at the conference, could further accelerate the adoption of tokenized assets and stablecoins by enabling smarter, more efficient financial processes.

The Federal Reserve’s October 2025 Payments Innovation Conference is poised to be a defining moment for the tokenization of real-world assets and the broader adoption of digital finance. By bringing together regulators, academics, and industry leaders, the event aims to foster collaboration and address the opportunities and challenges of integrating blockchain technology into the U.S. financial system. For investors, the conference signals a growing acceptance of tokenized assets and stablecoins, creating opportunities to invest in platforms like RWAX, Circle, and Ondo Finance, which are already scaling infrastructure and aligning with regulatory frameworks

---

---

---

Information Sources:

- [Federal Reserve](https://www.federalreserve.gov/newsevents/pressreleases/other20250903a.htm)

- [Ainvest](https://www.ainvest.com/news/fed-october-conference-catalyst-tokenized-real-world-assets-stablecoin-adoption-2509/)

- [Cointelegraph](https://cointelegraph.com/news/fed-prepares-conference-discuss-tokenization-amid-big-week-rwa)

---

___

_If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!_

## This post was created via INLEO. What is INLEO?

> [INLEO's](https://leofinance.io/) mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, [Inleo.io](https://leofinance.io), allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

---

---

### Let's Connect

Hive: [inleo.io/profile/uyobong/blog](https://inleo.io/signup?referral=uyobong)

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

---

Posted Using INLEO