One of the central ideas espoused by the WEF is the importance of public-private-partnerships (P3), where various stakeholders throughout society come together to solve the most pressing issues of our time. The WEF and Davos attendees are enthusiastic supporters of the model often touting P3 projects as "win-win" solutions.

In effect, public-private partnerships are contracts between a government and a private company where the company assumes responsibility to operate a sector or service previously controlled solely by the government. In this arrangement, the company finances, builds and manages the project and is typically compensated through a fixed payment plan with the government or through fees paid by users and in some instances both.

A 2013 whitepaper on public-private partnerships put forth by the WEF titled:

“Strategic Infrastructure: Steps to Prepare and Accelerate Public-Private Partnerships”

reads as a "how to" guide for governments looking to incorporate P3 into national policy on infrastructure. In fact, the whitepaper specifically identifies the "target audience".

This report is designed primarily for senior government leaders and for the officials responsible for planning and delivering infrastructure projects.

Amongst an exhaustive list of corporate management best practices are recommendations on how to facilitate project pipelines and ways to institutionalize P3 projects into government policy. The WEF paper stresses the importance of creating "P3 units" and experienced "advisers" with knowledge of both the private and public sectors with "access" to "key decision makers" to guide the project from start to finish. It also recommends "governments would do well to formulate a steady project pipeline" in the interest of attracting foreign investment.

Advocates for P3 are steadfast in the belief that P3 is the ideal vehicle for cutting through red-tape and delivering more efficient outcomes while also benefiting a wider scope of stakeholders.

In reality, P3 projects are in essence a repackaging of privatization of the public-sector and the fascist-like fusion of industry and state power masquerading behind feel-good progressive language. Despite the rhetoric, P3 are a far cry from being the vehicles of efficiency and innovation sold to a credulous public and can quickly devolve into a breeding ground of conflict of interest and corruption, as we shall see.

Fink's Bank and Think Tanks

In January 2016, fresh off an election majority victory in 2015 that brought the Liberals back to power, Trudeau and a delegation of Cabinet Ministers set off for Davos to attend the World Economic Forum.

Among the contingency was then Finance Minister William Morneau, Minister of Foreign Affairs Chrystia Freeland, Minister of Innovation, Science and Industry Navdeep Bains and Minister of the Environment Catherine McKenna. The aim of the Canadian delegation was straight forward, promote Canada as a cutting edge business friendly nation and drum up capital from large institutional investors. Their main target was BlackRock CEO Larry Fink.

It was a coming out party of sorts for the Canadian government, "there has never been a better time to look to Canada" declared Trudeau in his keynote speech at Davos. In the same speech addressing the Davos faithful, the Canadian PM jokingly stated that fellow Canadian Dominic Barton had probably worked for many in the audience at some point in his career. At the time, Barton was the Managing Director of McKinsey consulting agency well known for advising major corporations and governments alike.

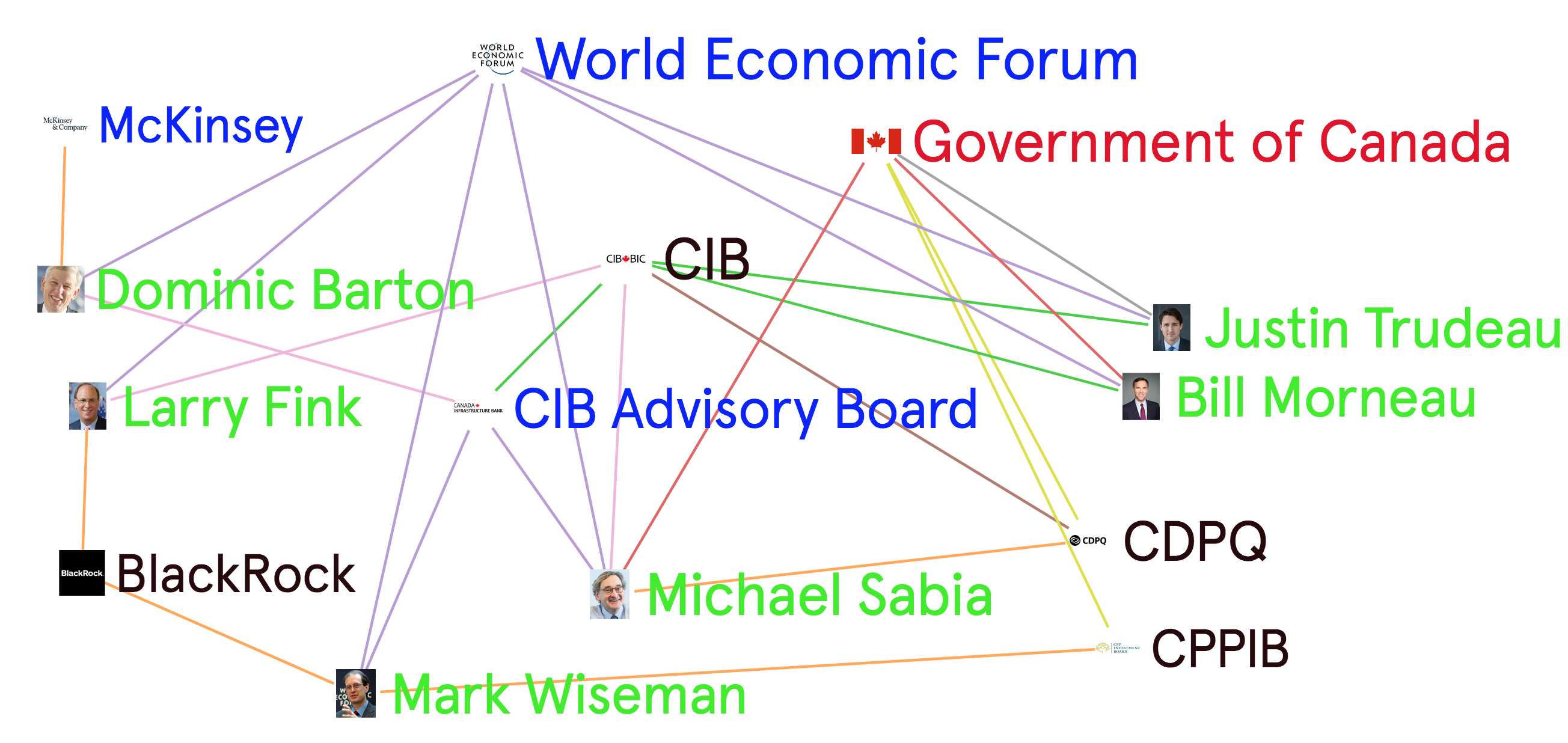

The 2016 conferenced marked the beginning of a courtship that would go on for several years between the government of Canada and the money management behemoth BlackRock in an effort to draw capital from the world's largest investors. It would also lead to the creation of the Canada Infrastructure Bank (CIB) and at the same time spark concerns over conflict of interest involving industry executives and Canadian government officials.

Key players in the creation of the CIB also happen to be members of the World Economic Forum.

Larry Fink - BlackRock CEO Justin Trudeau - Prime Minister William Morneau - Finance Minister Dominic Barton - Managing Director McKinsey Group Mark Wiseman - CEO of Canadian Pension Plan Investment Board / BlackRock Exec Michael Sabia - CEO of La Caisse de dépôt et placement du Québec (CDPQ)

BlackRock

Since the 2008 financial crisis, BlackRock has emerged as one of the pillars of Wall Street. Launching in 1988, BlackRock has transformed into the world's largest private equity firms. According to 2021 filings, BlackRock has over $10 trillion under management and simultaneously is a top shareholder in some of the largest and most successful publicly traded companies listed on the stock market.

BlackRock's top share holdings include:

Apple, Microsoft, Amazon, Google, Tesla, Facebook, Johnson & Johnson, Berkshire Hathaway, JPMorgan Chase, Pfizer, Bank of America, Visa, and MasterCard.

With its ever increasing trillions under management, easily dwarfing the GDP of every country in the world aside from China and the US, BlackRock's CEO and founder Larry Fink has become the toast of Wall Street.

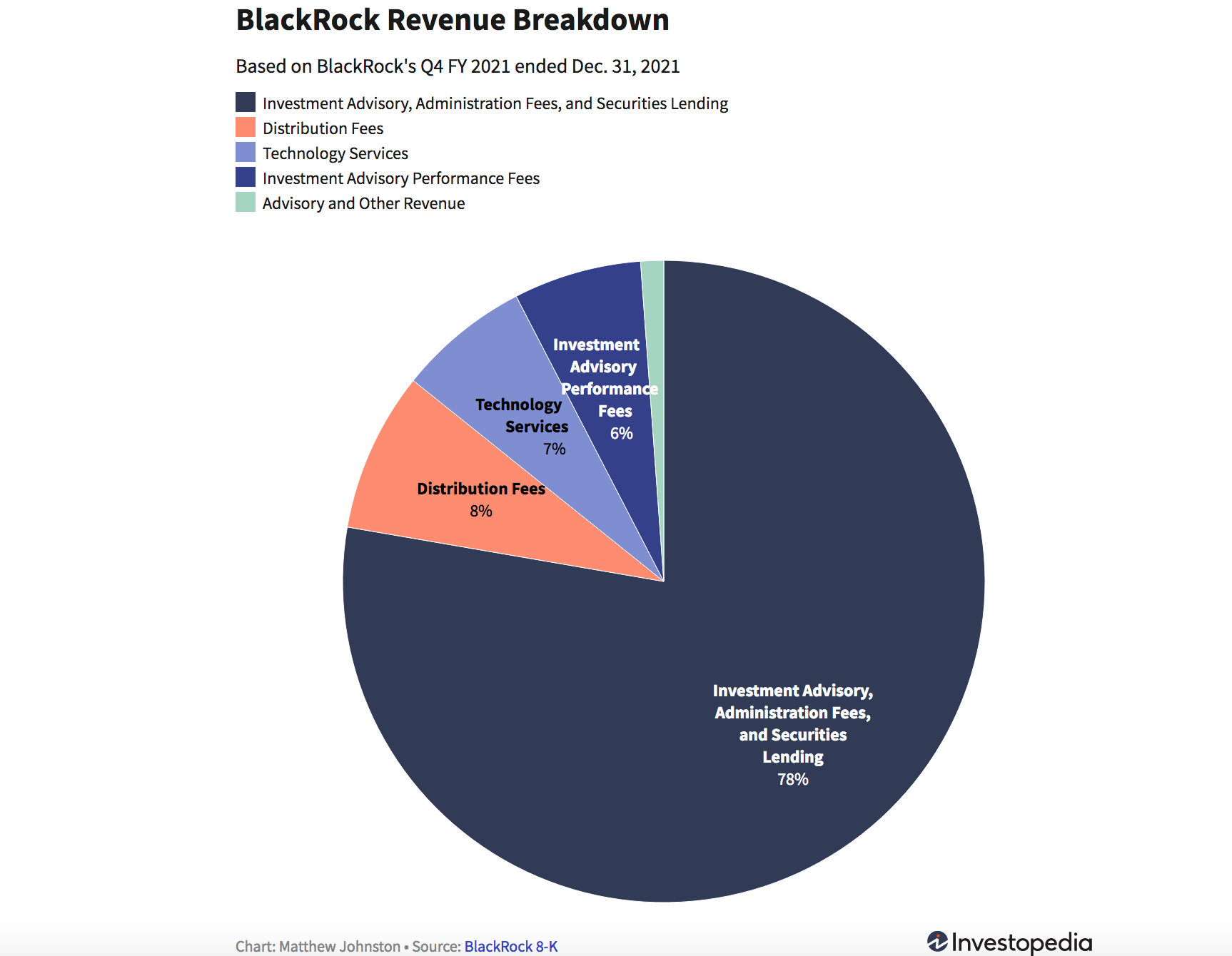

- Blackrock earns almost 80% of its $19.37B revenue (2021) from advisory and administration fees.

Wall Street's "Mr. Fix It"

During the 2008 financial crisis, Larry Fink and BlackRock were instrumental in averting a complete economic collapse as the story goes.

In 2008, the Federal Reserve Bank of New York brought on BlackRock mainly to assist in the management and sale of toxic assets held by Bear Stearns and AIG. At a time where many of Wall Street largest firm's stock prices were plunging BlackRock's stock began to soar.

There's some irony that the US Federal Reserve turned to Fink for help in 2008 as Fink had a hand in devising the toxic assets that triggered the crisis.

There is no shortage of drama these days in the credit markets, which happen to be Fink's specialty. Back in the 1980s, at First Boston, he helped pioneer mortgage securities, the kind of investments that are causing so much of the trouble now.

More than a decade later, BlackRock would be tapped once more to manage the Covid-19 relief program joining forces with the US Treasury and the Federal Reserve to oversee the allocation of $1.5 trillion CARES Act.

It has been documented that BlackRock's involvement in allocating billions of dollars in relief through the CARES Act in America represented a clear conflict of interest. Many companies that received relief funding were companies in which BlackRock was a top investor. Furthermore, it illustrated the ongoing entanglement of the US government and the private sector and the entrenchment of the firm in the financial system. To make matters worse, BlackRock is not subject to regulatory scrutiny or any sort of oversight and therefore unaccountable to the public.

Corporate America Reaps Egregious Sums | The CARES At

When not managing trillions of dollars in relief packages for governments, BlackRocK is a vocal proponent of privatization. CEO Larry Fink has long argued for the need for privatizing national infrastructure.

“Substantial expertise must be dedicated to bring projects to market in a format appropriate for institutional investment,” Mr Fink says. “These projects must deliver competitive returns and that will often require efficiencies that can only be achieved through private ownership.”

That BlackRock's CEO views echo the WEF's position that only the private sector is capable of delivering new infrastructure projects through P3s, should come as no surprise.

Fink is a regular fixture at the World Economic Forum as well as the Aspen Ideas Festival which is the closest US equivalent to Davos on the ultra-rich conference circuit. Fink has garnered quite a bit of media attention in recent years advocating for WEF-styled "stakeholder capitalism" and the importance of Environmental, Social Governance (ESG).

Larry Fink famously penned a letter to investors of BlackRock in 2019 where he advocated for the need for investors to consider ESG and Net Zero Climate Change targets. The "Fink Letter" set in a motion a wave of positive press that Wall Street was changing its tune. Yet, despite the adulation in the press BlackRock remains a significant investor in Big Oil and in large scale gas pipelines such as Saudi Arabia's Aramco project.

Coincidentally, ESG is yet another agenda item aggressively pushed forth by the WEF over the years. The Davos crowd sees ESG as another important tool in reshaping society publishing yet another Whitepaper on the subject.

Strong environmental, social and governance (ESG) performance has the power to unlock significant positive impact for investors, companies and wider society.

World Economic Forum

Once again, according to the WEF all of society benefits, but perhaps more importantly it benefits actors in the private sector while pandering to the public with progressive language and idealism.

The Creation of the Infrastructure Bank

Part of the Liberal Party's platform during the 2015 elections was the promise to provide middle class jobs for Canadians, to invest in "innovation" for the future and to modernize Canada's ailing infrastructure. The creation of an infrastructure development bank was included in the platform.

At the January 2016 Davos conference, McKinsey Director Dominic Barton organized a face-to-face private breakfast between Canadian PM Justin Trudeau and several of his cabinet ministers with Larry Fink and BlackRock executives. This initial meeting was fruitful as it spurred a series of additional meetings between the parties throughout 2016.

A few short weeks after the wrap up of the Davos conference, Larry Fink and Justin Trudeau met once again on March 16th, 2016, in New York city.

Almost immediately after Trudeau's meeting with Fink in New York, Canadian Finance Minister Bill Morneau announced the formation of the government's Advisory Council on Economic Growth (Advisory Council). The Advisory Council would study Canadian economic potential and make recommendations to the Finance Ministry. Morneau made the announcement on March 18th, 2016.

The Advisory Council would be chaired by none other than McKinsey & Company's Dominic Barton, the man that organized the initial meeting between BlackRock and Trudeau at Davos earlier that year.

Other players named to the Advisory Board were executives representing two of Canada's largest investment funds, Mark Wiseman then CEO of the CPPIB and Michael Sabia the CEO of Canada's second largest investment fund at La Caisse (CDQP).

The establishment of the "Advisory Board" and appointment of Barton as chair bears a striking resemblance to the "P3 Units" prescribed by the 2013 WEF paper.

Under Barton's guidance, the Advisory Board would make a series of reports, thin on details, suggesting ways to stimulate investment in Canada. The top recommendation made by the board being the creation of a new infrastructure bank that would help facilitate large scale infrastructure projects and attract funding from global institutional investors. The report also recommended a roadmap to attract more foreign capital. The infrastructure bank would employ P3 as a cornerstone in every project as shown on the CIB official website.

Executive Summary of ACEG First Report October 2016

Unleashing Productivity Through Infrastructure

The report highlights the types of infrastructure projects that the government should focus on with an emphasis on projects of $100 million or more to attract institutional capital.

Examples include toll highways and bridges, high-speed rail, port and airport expansions, smart city infrastructure, national broadband infrastructure, power transmission and natural resource infrastructure.

In May of that year, Mark Wiseman stepped down as CPPIB CEO after 4 years as top executive as well as 10 years with the fund, to join BlackRock on Wall Street as Senior Managing Director and Global Head of Active Equities. At CPPIB, Wiseman was instrumental in shifting the investment strategy of the fund from one of stocks and bonds to one of "active investing", particularly in global markets. At the time of Wiseman's departure the CPPIB had $280 million in assets under management.

Wiseman would join his wife at the firm, Marcia Moffat a former Royal Bank of Canada executive, who was named head of BlackRock's Canadian division the previous year. Despite joining BlackRock, Wiseman did not recuse himself from his seat on Barton's Advisory Council.

On November 14th 2016, BlackRock hosted a summit at Toronto's upscale Shangri-La Hotel closed to the press and the public. In attendance along with BlackRock executives, Trudeau and members of his cabinet were representatives from some of the world's most powerful international investors. The group was scheduled to discuss infrastructure "opportunities", but the full details of the meeting remain unknown. Among major investors in attendance were: Saudi Arabia's Olayan Group, Singapore's Temasek holdings, Norway's Norges Bank and McKinsey & Company.

It wasn't until the following year that some information surrounding the summit began to materialize. According to access to information documents obtained by Globe & Mail journalist Bill Curry, it was revealed that BlackRock and Canada's federal Privy Council Office had created "working groups" ahead of the summit and coordinated closely in preparing the federal government's own presentation for the private seminar.

In the lead-up to the summit, BlackRock reportedly participated in biweekly conference calls with Infrastructure Canada and the Privy Council Office to create a presentation Infrastructure Minister Amarjeet Sohi was to deliver to the investors.

This is where conflict of interest concerns comes into sharper focus. BlackRock, a potential investor in Canadian P3 infrastructure projects was writing the policy for the government of Canada from which they would directly benefit.

It was also later revealed that Trudeau had hired an "unidentified" banker to help advise the government on the CIB. The unnamed individual had previously been employed by Merril Lynch and Bank of America.

Merril Lynch and Bank of America have close ties to BlackRock. In 2006, BlackRock merged with Merril Lynch Investment Management. In addition, Bank of America purchased Merril Lynch in 2008 during the financial crisis. BlackRock is the 3rd largest shareholder of Bank of America behind Vanguard and Berkshire Hathaway (in which BlackRock is also a large shareholder) with a 6% stake.

Just days after BlackRock's summit in Toronto wrapped up, Finance Minister Bill Morneau released the 2016 Fall Economic Update report. He announced the Liberal government's plan to create and seed fund the Canada Infrastructure Bank, closely following the recommendations of the Advisory Council developed by McKinsey and BlackRock executives.

Fall Economic Update November 2016

As a 2021 investigative report describes:

Morneau outsourced policy-making about the bank from his department to this advisory-council - and through Barton to McKinsey Consulting, which has largely been responsible for the content of the council's flimsy reports.

In February of 2017, Trudeau announced the appointment of Jim Leech as special Advisor to the CIB. Before retirement in 2014, he was the CEO of the Ontario Teacher's Pension Fund. Leech is a long-time friend of Mark Wiseman, the two often take ski trips together. The pair also previously worked with each other at the CPPIB.

In the spring of 2017, Morneau tabled the annua