Hi HODLers, Hiveans and Lions,

I have been quite busy lately so I oversaw the PPI data last week but did not take the time to dig deep.

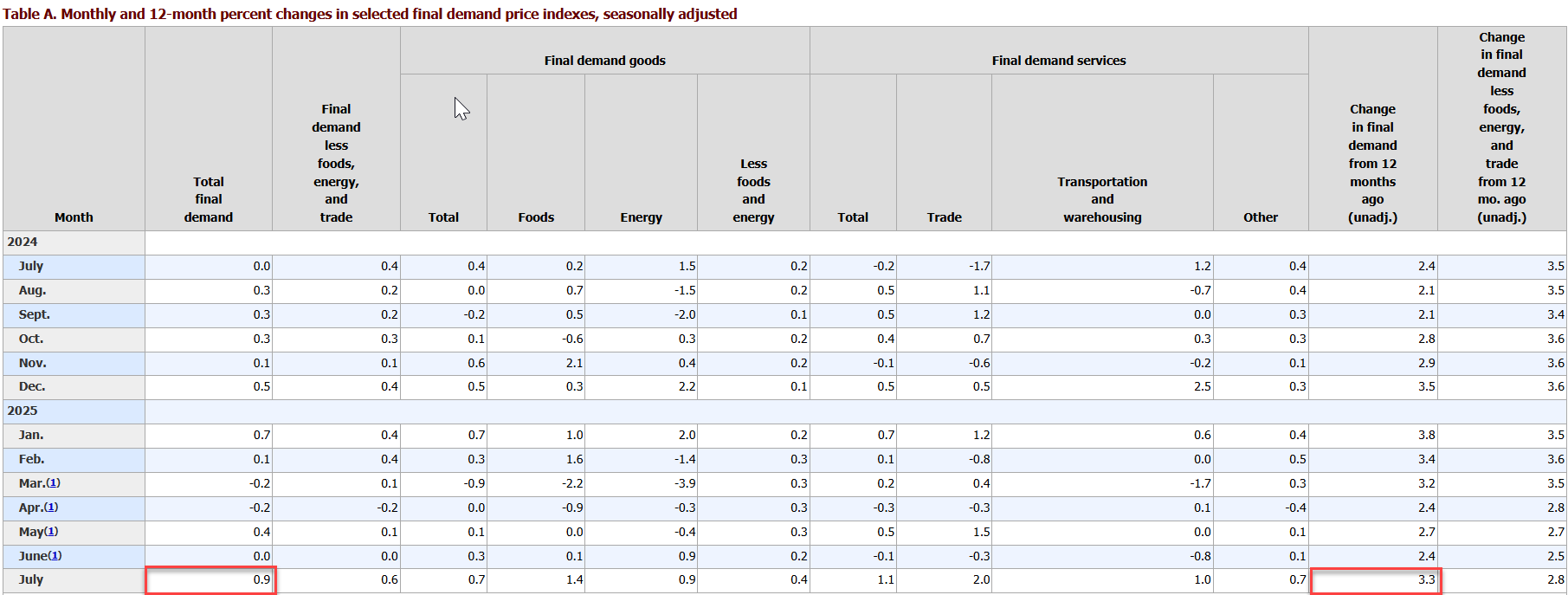

It was a very important data point as the July 2025 data was in my opinion, the first month where we could see the tariff impact.

I will not post all the different table that you can find on the official BLS website here but the price increases were quite broad on the goods and services side.

As rent also seems to be picking up in the US, I expect inflation to break upwards of 3% YoY before the end of the year. If this is the case and unemployment does not jump substantially. I do not see a path for the FED to cut interest rates in September.

What does that mean for Stocks and Crypto markets?

If they were to do it, it would only be adding fuel to the fire. Stocks and Crypto prices being elevated, we could see a consolidation which seem to have already started. 2nd quarters results for US Companies have been good so it seems like the economy is doing fine so far.

In my mind, that means we will consolidate for a while at these levels.

Does this make sense to you? Do you see anything I might have missed?

Stay safe out there,

Posted Using INLEO