Hi Investors,

As you have noticed, crypto, stock and bond markets have been quietly stabilizing for the past week. A big narrative is that the market is currently overweight in terms of P/E Ratio and other metrics such as the Case-Shiller PE Ratio reaching Dot.Com bubble like levels.

Scary, right!?

I am not arguing the fact that the US Stock Market's valuation and in particular the Magnificent 7's one is expensive. But, it is also not a similar situation to the Dot.com Bubble.

If you strip out Mag7 from the SP500, the valuation is quite normal around 17/19x P/E NTM (Next Twelve months). The Mag7 have higher multiples and therefore distort the SP500 P/E.

As we'll see below, these companies have higher valuations because they are growing faster and keep having these estimates bumped up as they surprise to the upside!

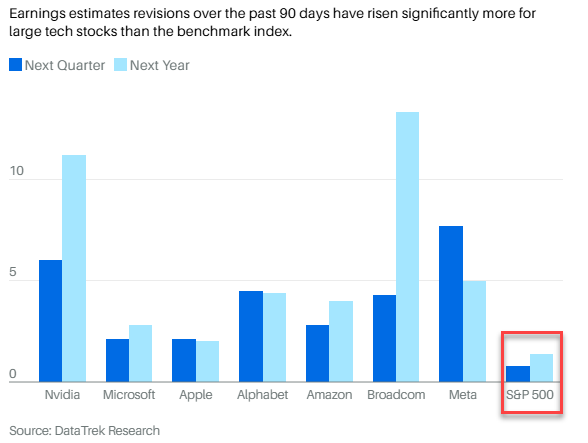

Big Tech Earnings Estimates Revisions Outpace the S&P 500

- Earnings estimates for the group have risen 4.2% on average for the fourth quarter and 6.1% for the full year 2026.

- That at compares to just 0.8% and 1.4%, respectively, for the S&P 500.

AI's spending is big! But not as big as during the Dotcom Bubble

Latest research shows tech spending contributed 2% of GDP in the second quarter of 2025.

During the personal computer boom of the 1980s, it was 2.6% and it was 2.9% during the internet bubble of the late 1990s and early 2000s.

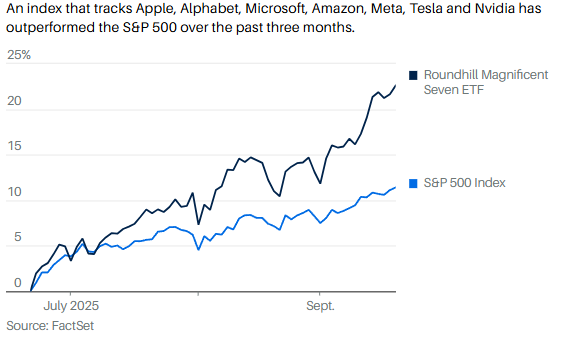

The Mag Seven are leading the charge

Wells Fargo chief equity strategist Ohsung Kwon summed it up quite well on a note to his client on September, 9th:

“[The] music stops when the AI capex stops". “Enjoy the party.”

Stay safe out there,

Posted Using INLEO