Time to talk about BINANCE FUD - and what it means for the ECOBANK

Boy what a crazy world we live in! I was talking last week to my dad about crypto, and after trying to explain about FTX and SBF, which mostly came down to talking about leverage and fraud, my dad asked me, I think genuinely, "But you're not doing any of that type of risky stuff right?"

"Of course not Dad".

I continued to do some research about the topic, but I thought it was just about concluded. Some shady stuff happened, but ECO took no part in it - his projects are safe, even from contagion. Yay!

Then I read about Binance

There hasn't been a lot of really thorough information, what started can only be described as light-FUD on twitter, and mostly it seems done by already insolvent butt-hurt exchange managers that probably think it would look better for them if there wasn't some Chinese Billionaire 'still standing'.

Here's a pretty good summary from ZeroHedge today: https://www.zerohedge.com/crypto/not-binancial-advice

And so a few days after announcing to my dad that I successfully navegated this cycle of crypto and missed all the risks and rugs and scams - I realized, if Binance goes down right now I am screwed!

Contagion risks with BUSD

Shit, well actually ECOBANK was sitting on like 25k BUSD, some of it earning yield, which we will talk about later. But, if BUSD were to depeg, we would be screwed because.... because.... I used a trick 🤦♀

Okay so I have successfully used this trick 5 times now, I guess its time I tell you all about it, especially those of you involved in the ECOBANK project.

All deals are worked out in money, but there is also another variable to play with, this is time. In the US, Bank's control time by controlling money, for this they charge interest. But here in Colombia, I have had a lot of success doing what are basically contract-backed seller-loans. I buy the property and agree to a payment schedule, some money upfront and usually take control of the property right away.

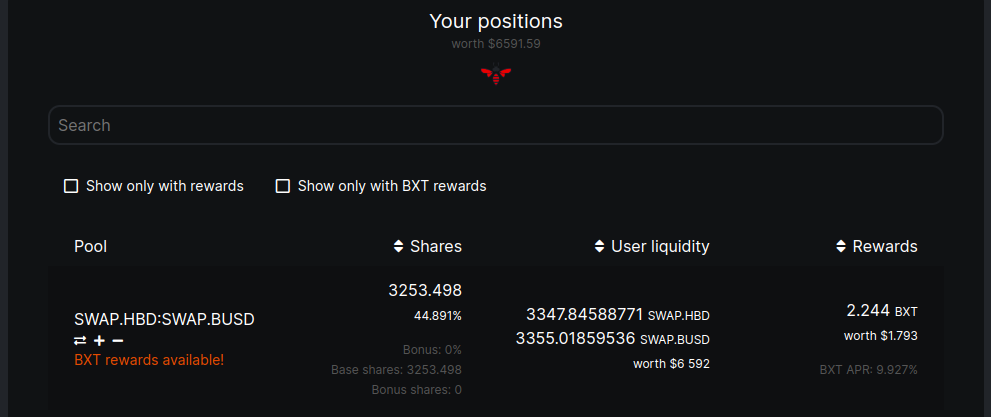

Here's the specific example with ECOBANK. We agreed to buy into 1/2 of the property for 180 million pesos. We have so far paid 55 million, and we were sitting on a pile of BUSD and some HBD, earning yield in HIVE in the meantime. One interesting note is that when we completed the ECOBANK presale, we did not have enough money to fully pay this property. We still don't in fact, but it has gotten a lot closer due to the dollar pump (and not including yield!).

I didn't have time, so we trusted an admin in the beginning, but next year I will be doing the administration and it should be a main topic on my blog.

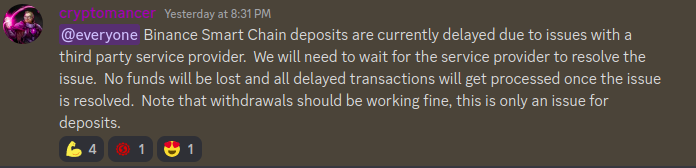

So a few days ago we were sitting on over 20k BUSD until I made some quick moves. As of the time of posting that number is down to under 3500 BUSD.

Wait, what's the risk again?

Okay, so ECOBANK has this Casa Lago property 'backing' its tokens. This land is an asset in the fund.... Except, we haven't really paid for it all yet. In a sense, we have a liability on one side (no interest property loan with the seller), and on the other side we have assets earning yield (and fluctuating in value).

So while it looks good on paper, if our assets were suddenly worthless, it wouldn't be looking so good.

Most of the moves have been made, we are down to less than 3500 BUSD, as seen in the image above. The rest of the funds are in the pipe being converted through dollars to pesos and on their way to making a payment very shortly. We have already talked to the seller (who is also our partner in the property), and we are finalizing the plans to build the admin suite. Promising winds blow on the horizon.

3500 BUSD / 7000 at risk

Okay, but back to the funds, we still have some BUSD, and its not just being held its actually pooled with HBD. Unfortunately, while HBD is safer than BUSD, the pool is a dangerous place to be if BUSD depegs, because we may end up holding all BUSD and no HBD. So there is still some money at risk here.

And I likely will move it soon. I am keeping my eyes open, that is for sure. I feel very good that we limited the risks by over 18k USD already, and it will take me several more days to complete their transition into Colombian Pesos. But we are still earning some yield, the @ecobanker account has become quite robust and its current base of hive funds will serve us well over the coming years.

So I am obviously hoping we don't lose this money. I recently (before this) had some consideration to see what I could do to leave it there, including buying a few more ECOBANK tokens myself and using phsyical cash pesos to pay the property off. I am keeping my options open for now - but what do you all think about this? If there is any level of risk to BUSD I would rather move it out of here and just pay down our liability.

Feedback

One of the imporant things about projects like these is that we are a group, you guys are supposed to add your wise council. Sure, I am your manager and you love me because I have some understanding of the details of this trade. My commitment to you guys is to be transparent and communicate, which can open windows of feedback, like the comment section of this article.

If you hold any number of ECOBANK token, please consider leaving your comments about our not-over but now-hedged BUSD contagion risk, my buy-now pay-later land funding mechanism, or even our administration situation. If you don't own ECOBANK, you can opine too, but please understand your position (nothing) when constructing your feedback.