Since the Steem blockchain officially launched and produced its first block on March 24, 2016, a lot has happened. Steem has transformed from a project that many cryptocurrency investors initially thought was a scam / “pump-and-dump” campaign, to an established and respected blockchain project with several of the most heavily used decentralized applications (DApps) in the blockchain industry.

Today STEEM is one of the top 50 cryptocurrencies (based on market capitalization), and is getting ready to position itself as serious contender for the top 10 cryptocurrency projects once Smart Media Tokens (SMTs) launch in Q1 of 2019.

In this article, we will explore the Steem blockchain and STEEM cryptocurrency, looking at both the positive aspects and negatives. The goal of the article is to be as comprehensive of an overview of Steem as possible, so those interested in Steem can learn more about it.

[image source @podanrj]

This work is licensed under a Creative Commons Attribution 4.0 International License.

[image source @podanrj]

This work is licensed under a Creative Commons Attribution 4.0 International License.

Disclaimer

Before we get too far into the article, let’s get the fun “legal” stuff out of the way..

This article does not constitute investment advice. Everything in this article is just my own personal opinion and observations. Anything that could be considered a prediction of the future has no guarantee of coming true. It is possible that information in this article is (unintentionally) inaccurate or incomplete. Do your own research before making any investment decisions. The author of this article holds STEEM tokens as well as several other cryptocurrencies.

Steem’s History

Steem is an established blockchain project that has been around for over two years, and there is a lot of history with the project (both good and bad). Not everything has gone exactly as planned; mistakes have been made, and some of the decisions made along the way may not have been the right ones in hindsight.

It is interesting to see investors pouring billions of dollars into ICOs each year. It is understandable why though. ICOs are easy to speculate on. There is no product yet. All that there is are hopes and dreams of a future yet to come. It is easy to imagine what an ICO could become, when nothing has been built yet.

A live project is much harder to speculate on. We know what the project will do. We know the mistakes that have been made. We know what its limitations are.

While many would point to the mistakes and shortcomings of a project as evidence for investors to stay far far away, I believe there is a lot more to be learned by reviewing what has happened to see how the project is evolving. To quote Steemit’s Content Director @andrarchy, I would much rather see a project that has “gotten punched in the face a few times and is still advancing forward” than one that is still in the conceptual stages and hasn’t had to deal with anything major going wrong yet.

Let’s start by exploring a few of the things that didn't go so well for Steem.

Questionable Launch

If you look at the launch (and re-launch) of the Steem blockchain on BitcoinTalk.org, the reaction from many was far from pretty. A lot of of commenters indicated that insufficient documentation was provided on how to setup a node, the project seemed like a scam, and many suspected it was just an elaborate pump-and-dump scheme by the founders.

Later, one of the founders (Daniel Larimer, who also founded EOS) wrote an article titled How to Launch a Crypto Currency Legally while Raising Funds, which explained why the project was launched the way it was. What it boiled down to was that in order to not be considered a security, they couldn’t pre-allocate any tokens to themselves (or others), and they had to complete the currency and protocol prior to launch. Yet, at the same time, they wanted to acquire a large portion of the initial tokens for themselves in order to fund the ongoing development of the project. They accomplished this by mining a large portion of tokens for themselves after the blockchain was officially and publicly launched.

While it may initially seem shady for the founders to have mined a large percentage of coins for themselves, the intention and use of those coins is really what matters. If you fast forward to today, it is pretty clear that Steem was not a pump-and-dump scheme. There was a long-term vision for the product, and that vision is in the process of being carried out today.

What is interesting is that if an ICO were to award the founders and core development team with a large share of initial tokens, investors would not really have a problem with that. Many blockchain ICOs allocate 30-40% of their tokens to the founders / dev team. The main difference between what these ICOs and Steem did was that with Steem there was no ICO - so any initial tokens had to be acquired through mining.

Incomplete Product

When the Steem blockchain (and front-end website steemit.com) was launched, they were launched as an MVP (minimum viable product). The majority of features that would be necessary in order for Steem to compete with Reddit, Facebook, and other social media giants had not been completed yet.

Over the past two years, the development team has been building features around us. We have seen basic stuff like follows and sharing (called “resteems”) added, as well as more advanced features such as escrow payments and the ability to collaborate and share post rewards among multiple authors. The project has come a long way already, and new features continue to be developed and added, but there is still a lot more work to be done before the platform will truly resemble what most users expect to see when they think of a social media platform.

While it is easy to look at a completed product that is already well-polished and has all the fancy bells and whistles to attract and retain users, it is much harder to look at a work-in-progress project and see the product for what it will likely become. Steem is still a “work-in-progress” project. What you see today is still only a preview of what it will likely become over the next 1-2 years.

Token Distribution and Misuse of Stake

There is a small group of people who were very-early-adopters, as well as some large investors who have bought into the platform since its launch. This small group of individuals (combined) holds a very large stake in the platform, and collectively they have significant influence over the decisions of what content gets rewarded, and which witnesses are voted into (and out-of) power.

A lot of users have become upset when these large stakeholders (i.e. “whales”) have used their stake in ways that benefited themselves (or their friends) more than the community as a whole. Users have also gotten upset when large stakeholders have downvoted content from other users in ways that have not always seemed right/fair. (This has especially been true in cases when the stakeholders in question have been the founders.)

Even though each user's stake is theirs to use however they choose, the feeling of unfairness that has arisen due to the inequality of stake among the users has harmed the user experience and perception of the platform.

Over time as new investors buy into the platform the control of this “small group” is being diluted, although it will likely take a significant amount of new investors coming in before the influence over the platform becomes more widely decentralized.

Steemit, Inc. Witness Voting

When I first joined the platform, the rumor on the street was that only the super-early-adopters and people that were friends with Dan L. / Steemit, Inc. were voted in as witnesses. It was also implied that witnesses had to go along with what Steemit, Inc. wanted - or they would be voted out.

While that may have been the case early-on, it does not seem to be the case anymore. Myself (and several others) who had no prior connections to any of the early adopters or Steemit, Inc. have made our way into the top 20 witnesses by working hard and proving our worth to the community.

Back in March 2017, there was a hardfork where the witnesses were not in support of the changes that Steemit, Inc. proposed (hardfork 17). Steemit ended up changing the code and releasing a new hardfork (18) to one that the witnesses did support.

Since that time as well, the Steemit, Inc. employees who were running witness nodes (such as @roadscape) have suspended their witness campaigns, and Steemit, Inc. employees are no longer participating in witness voting.

To me, this demonstrates a huge step forward in that the core development team (Steemit, Inc.) is respecting the wishes of the other stakeholders, even though they still technically have an overriding stake.

Steemit, Inc. Communication

One of the bigger complaints about the project when I joined was that the communication and transparency from the core development team was severely lacking. Nobody knew what they were planning to work on, promises were made and never kept, and there was little explanation for any decisions that were made.

Over the past six months, they have made a complete “180” and have started communicating regularly with the community. Their account (@steemitblog) has been making regular posts every week, and they have been doing an excellent job telling everybody in the community what they are working on, and what we should expect to see happen. There are also now open lines of communication between the core dev team and the witnesses, community developers, and several of the largest stakeholders.

User Onboarding

When I first found out about Steem, they were not accepting any new signups. I applied to be added to their waiting list, and eventually got an email a few weeks later to create an account. For an “everything now” society that wants to have everything right away, this was a little bit of a deterrent; but at the same time I felt that I was on a list to join a cool new exclusive club.

The primary (free) signup service to create an account has been streamlined a bit, although there are still often long wait-times for users. If you go to https://signup.steemit.com/ you can apply for a free account by verifying your email and phone number. The signup is free, but expect to wait 1-2 weeks to get an account.

Alternatively, third-party services such as Blocktrades.us and AnonSteem have sprung up, which allow users to pay a small fee to instantly create a Steem blockchain account. More information on the available signup services will be covered in a section below.

Steem Features

Now that we have explored some of the shortcomings of the project, let’s look at some of the things that Steem does well at.

Three Second Confirmation Times

Unlike the Bitcoin and Ethereum blockchains, where sending tokens to other users often takes several minutes (sometimes hours), transactions on the Steem blockchain are lightning fast - confirming in approximately three seconds. This means that users can transact with each other in real-time, making digital payments via the Steem blockchain practical for everyday purposes.

Easy to Remember Wallet Names

Most blockchains have difficult to use wallet addresses like 38hDQKmMgJQeK74USYuP4SRWnots2rk5h7 (BTC) and 0x7157Da4744f3df0CC2B42a02f1229d25D2b00E5A (ETH). This makes sending payments very difficult for “regular people”. With Steem, a person’s wallet address is the same as their account name (such as timcliff), which means it is much easier for users to send tokens to friends or businesses.

Vested Stake Instead of Transaction Fees

With most blockchain protocols (such as Bitcoin and Ethereum) every time you make a transaction, the blockchain charges a small fee to process the transaction.

With Steem, there are zero fees for all transactions. Instead, the blockchain requires users to purchase and “vest” some STEEM (i.e. HODL for 13 weeks) in order to freely transact. As long as users are holding a small amount of vested STEEM (called “Steem Power”), the blockchain allows them to transact for free. The more Steem Power an account has, the more they are able to transact.

This makes the Steem blockchain an excellent candidate for projects looking to use microtransactions, or games such as CryptoKitties which require users to complete multiple actions in order to play the game. This allows businesses and users to focus on what really matters - i.e. playing the game - rather than worrying about how every action taken will result in fees.

High Volume of Daily Transactions

Application developers who are interested in creating blockchain powered DApps that may need to support millions or billions of transactions per day should seriously consider the overall capacity of the blockchain network they are building on.

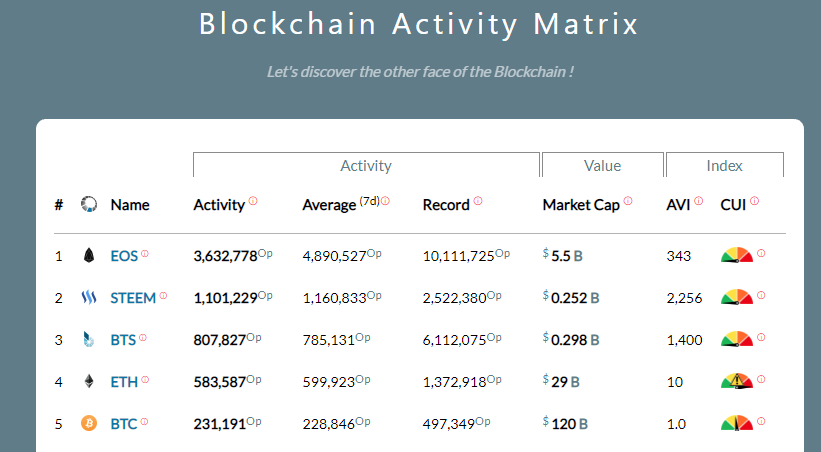

Steem is one of the most heavily transacted blockchains in the world. With over 1M transactions per day, the only other blockchain producing more transactions is EOS. Steem is one of the few blockchains currently in existence that is positioned to scale to supporting billions of transactions per day.

[Image source blocktivity.info]

[Image source blocktivity.info]

Annual Inflation

The Steem blockchain originally launched with 100% per year inflation. Back in 2016 this was deemed unsustainable, and the inflation rate was lowered. This got changed along with several other improvements to the economic system of Steem as part of hardfork 16.

Since hardfork 16, the inflation rules have been defined as:

Starting with the network's 16th hard fork in December 2016, Steem began creating new tokens at an annual inflation rate of 9.5%. The inflation rate decreases at a rate of 0.01% every 250,000 blocks, or about 0.5% per year. The inflation will continue decreasing at this pace until the overall inflation rate reaches 0.95%. This will take about 20.5 years from the time hard fork 16 went into effect.

Digital Content on the Blockchain

Steem offers users the unique ability to publish and store different types of content directly and permanently into the immutable ledger of the blockchain as plain text. Once stored in the blockchain, data becomes available publically for developers and front-end websites (such as steemit.com) to use.

(source)

Censorship Resistance

Because the content that is stored on the Steem blockchain is distributed across the globally distributed network of decentralized Steem blockchain nodes, there is no single place that the content is stored. This means that it would be very difficult for an authoritarian government or party to force the removal of any content. It also means that if individual websites (such as steemit.com) decide to censor what content they display via their website, users will still be able to access the uncensored data through other sources.

Rewards Pool

The users who produce content and other types of contributions are adding value to the network by creating material that will drive new users to the platform, as well as keep the existing users engaged and entertained. This aids in distributing the currency to a wider set of users and increases the network effect.

The users that take time to evaluate and vote on contributions are playing an important role in distributing the currency to the users who are adding the most value. The blockchain rewards both of these activities relative to their value based on the collective wisdom of the crowd collected through the stake-weighted voting system.

(source)

DPoS Governance / Hardforks

By defining the rules for when a hardfork occurs, the witnesses elected within the DPoS framework can quickly and efficiently decide on whether or not to move forward with a proposed hardfork, allowing the Steem blockchain protocol to evolve more rapidly than most others.

The Steem blockchain has already successfully forked 18 times, and each time a hardfork has occurred, only a single chain has persisted after the fork. This is very different than what frequently happens on other blockchains when they decide to fork, where the result is often two separate chains after the fork (such as what happened with Ethereum Classic, Bitcoin Cash, and Bitcoin Gold).

Because the witnesses are elected by the stakeholders, they are naturally incentivized to vote in favor of changes that are in the best interest of Steem. This positions the Steem blockchain (and other similar DPoS protocols) to uniquely and quickly adapt to changes in order to continue innovating.

(source)

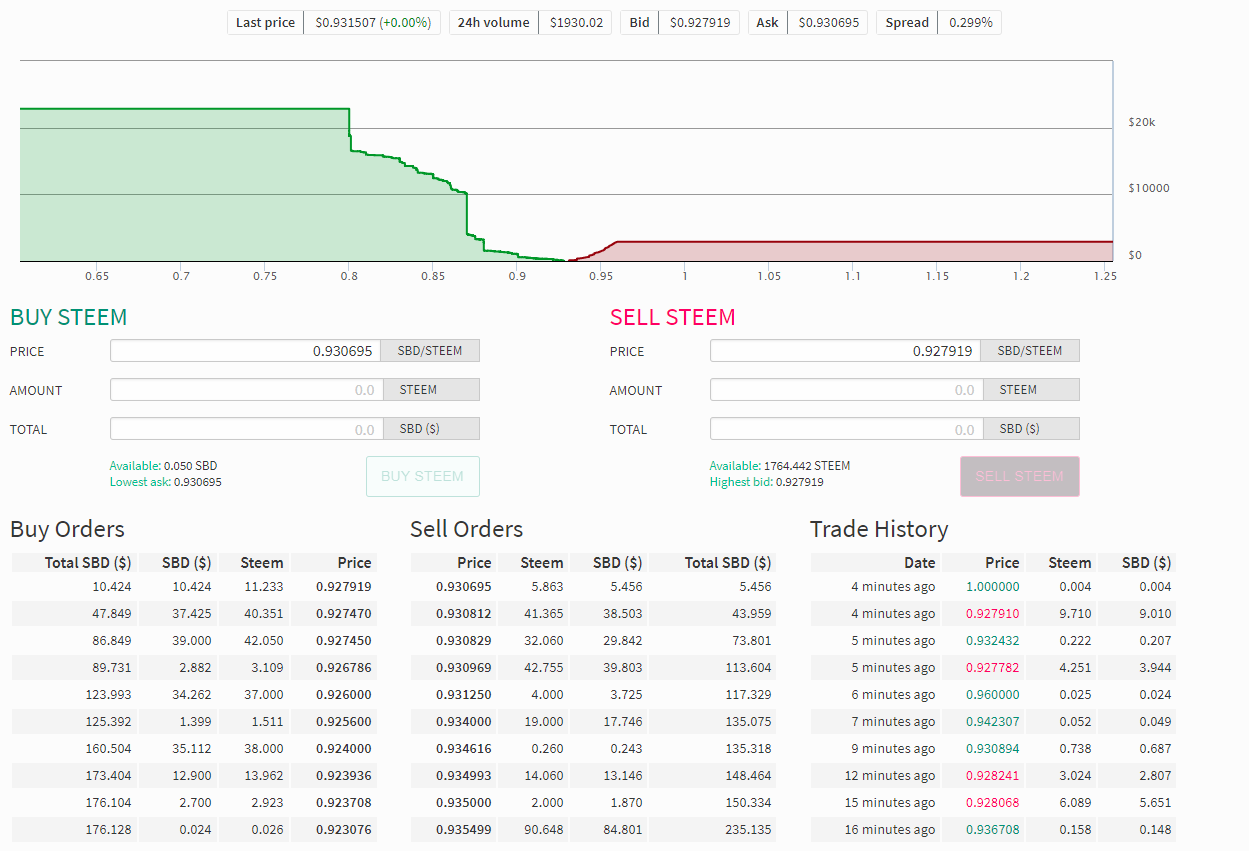

Decentralized Exchange

The Steem blockchain offers a decentralized token exchange, similar to the Bitshares exchange. The exchange allows users to trade their STEEM and SBD tokens through a public decentralized peer-to-peer market. Users are able to place buy and sell orders, and order matching is performed automatically by the blockchain. There is also a publicly accessible order book and order history which users can use to analyze the market.

Users can interact with the exchange directly using the blockchain’s Application Programming Interface (API), or use a Graphical User Interface (GUI) such as the one on steemit.com.

(source)

Payments Through Escrow

The irreversible nature of blockchain transactions is an important security feature, although there are many cases where users may not be comfortable sending their tokens to another individual without a way to get them back if the other user does not hold up their end of the agreement. The Steem blockchain provides a way for users to send coins to each other along with a third party designated as an escrow service. The user acting as the escrow service is able to determine if the terms of the agreement have been met, and either allow the funds to be released to the receiver or returned to the sender.

(source)

Hierarchical Private Key Structure

Steem employs a first of its kind hierarchical private key system to facilitate low-security and high-security transactions. Low-security transactions tend to be so